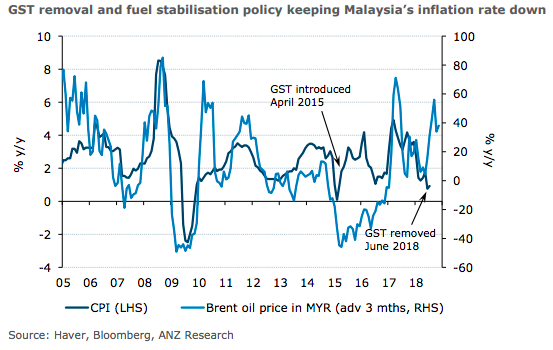

Malaysia’s headline consumer price inflation for the month of July increased only marginally, compared to that in June. Most components of the CPI index remained close to their June levels, barring electricity prices, which more or less reverted to May levels after dropping sharply in June. The headline figure remained buoyed because of an unfavourable base effect in fuel prices, though this is set to change in the coming months, ANZ Research reported.

Headline CPI inflation increased marginally to 0.9 percent y/y in July, from 0.8 percent y/y in June. The zero-rating of the GST since 1 June had resulted in a 1.2 percent m/m decline in the CPI index in June. Retailers and service providers do not seem to have reduced prices any further in July.

There was no dominant base effect, except for an unfavourable one in the case of fuel prices. The price of the commonly used RON95 grade petrol remains fixed currently at a subsidised level of MYR2.20 per litre, compared to an average of MYR1.96 per litre in July 2017.

"Given low inflation, the softer-than-expected growth outcome in Q2 and policy uncertainties, we expect BNM to maintain the ‘neutral’ tone and remain on hold for the rest of the year. The central bank will stay accommodative, but is unlikely to cut the Overnight Policy Rate (OPR) and jeopardise the relative resilience of the ringgit," the report commented.

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist