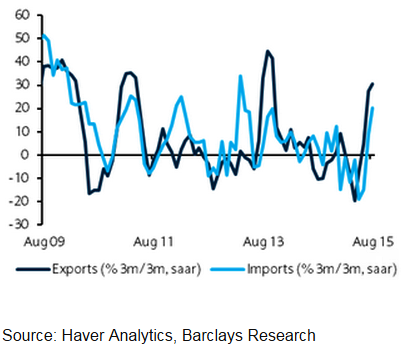

Malaysia's trade surplus widened significantly to MYR10.2bn in August, improving from a bn surplus in July due to much stronger exports as well as weaker-than-expected imports.

Exports continue to do well, rising 4.1% y/y in August, largely on strong increases in metal products (41.7% y/y), electronics (16.7% y/y) and machinery & appliances (12.3% y/y). Imports however fell sharply, contracting 6.1% y/y (Jul: +5.9%), with petrochemicals and crude imports behind the decline. This is a reversal of the jump in these items in July, which typically tends to be one-off, before reverting back to normal.

"Export momentum remains resilient, but likely to soften going forward. With the higher currency volatility in Asia and weakening demand in China, Malaysia's export performance is likely to remain modest over the rest of 2015. In terms of markets, exports to China remain strong (32.4% y/y), as well as to the US (24.2% y/y)", says Barclays.

Despite the much wider trade surplus, the current account is expected to deteriorate at the margin in 2015. Malaysia has recorded a trade surplus of MYR54.2bn in the first eight months of the year, up slightly from MYR52.2bn in the year-earlier period.

"The current account position is likely to remain comfortable, as capital imports are likely to slow down in coming months due to the weaker MYR. Despite recent capital outflows, we believe Malaysia's external debt position also remains serviceable. Malaysia's 2015 GDP growth is forecasted at 5.0%, versus 6.0% in 2014", added Barclays.

Malaysia's capital imports to slowdown due to weaker MYR in coming months

Wednesday, October 7, 2015 5:10 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX