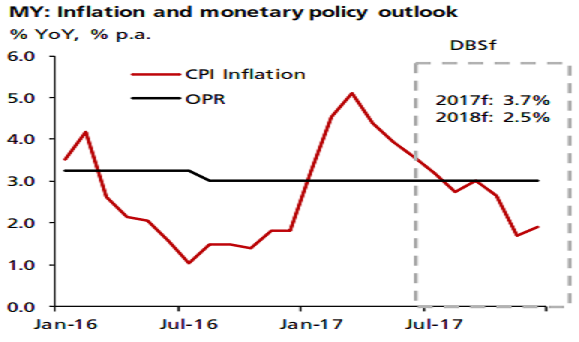

Malaysia’s headline CPI inflation for July due tomorrow is expected to register 3.2 percent y/y, down from 3.6 percent previously. While food inflation will remain elevated, transport inflation is still the main driver. For example, transport cost was up 10.5 percent y/y in the previous month on account of the low base in the same period last year.

However, it was also the moderation in transport inflation that led to this easing in the headline figure. The former was down from 13.1 percent in the month before and off the peak of 23.0 percent in March. In addition, transport inflation will likely continue to moderate in the coming months and driving the headline CPI inflation figure down with it as well.

In this regards, Bank Negara has kept policy rate unchanged at 3.00 percent thus far even though real policy rate is negative. Moreover, while headline inflation has been higher than policy rate, core inflation has remained stable (2.5 percent y/y in June). In short, an easing inflation coupled with an improving growth outlook mean that the central bank is in a sweet spot to maintain an accommodative monetary policy.

"Indeed, we continue to expect Bank Negara to keep the OPR at 3.00% for the rest of the year," DBS Bank commented in its latest research report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality