Following two months of decline, Hungarian industrial production growth returned to positive in November. However, growth was capped at just 0.6 percent, in both adjusted and non-adjusted terms, data from the statistics office KSH showed on January 6.

Despite a slight improvement compared to a 2.1 percent drop in industrial output seen in the previous month, the continued poor performance of industry suggests the economy is unlikely to meet the government’s target of 2.5 percent for full-year GDP growth.

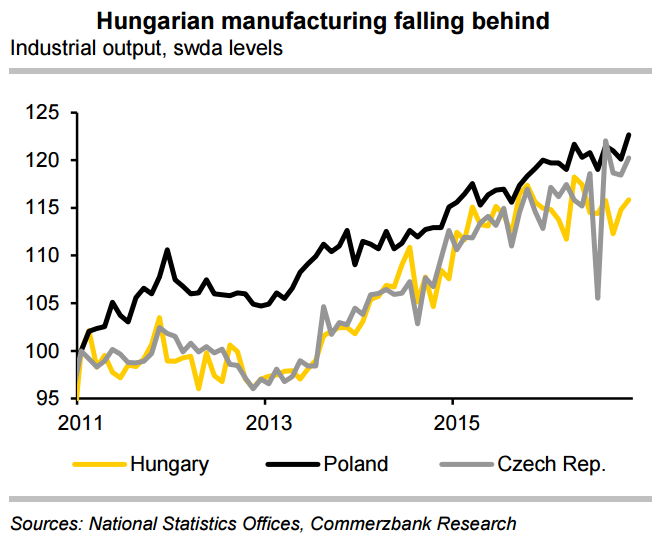

The result is disappointing in comparison with stronger recoveries across the region. Ignoring the headline year-on-year readings, manufacturing trends via seasonally-adjusted industrial output levels, show that Hungarian manufacturing has begun to distinctly lag behind Polish and Czech production.

Polish and Czech production accelerated in November driven by a pickup in German orders, whereas Hungarian output level stagnated, unable to move ahead of levels reached already in 2015. Hungarian industry has seen an erratic year, mainly due to the ill-effects of the auto sector’s struggles.

Looking ahead, although confidence in industry increased both in November and December, a sharp decline in PMI and pauses in production at the Hungarian factories of German carmaker Audi suggest industrial production in December is likely to remain subdued.

"We do not anticipate noticeable pick-up in coming months, and as a result estimate slower 1.3% growth for 2017. This is why we expect MNB's monetary stance to remain more accommodative than those of NBP or CNB. We expect EUR-HUF to move up towards 315.00 over the coming quarter." said Commerzbank in a report.

EUR/HUF was trading at 308.07 while USD/HUF was at 292.72 at 11:25 GMT. FxWirePro Currency Strength Index showed Hourly EUR strength was at 40.4645 (Neutral) and Hourly USD strength was at -40.5326 (Neutral) at 11:30 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility