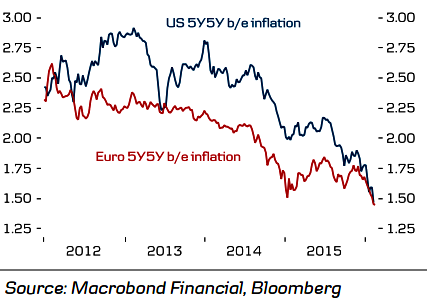

Long-term inflation expectations in both the US and the euro area have trended lower for a long time and at 1.5% are clearly below inflation targets (2% for the US and below but close to 2% for the euro area). While Fed officials have worried about inflation being too low, they have also maintained that the factors holding back inflation are transitory. Significant gains remain a challenge against the backdrop of tighter financial market conditions, recent sharp stock market sell-off and slowing domestic and global growth.

Data released last Friday showed that US overall CPI remained unchanged in Jan after slipping 0.1 percent in Dec. The CPI increased 1.4 percent in the 12 months through Jan, the biggest rise since Oct 2014, after gaining 0.7 percent in Dec. We are skeptical that the rise in core CPI would be sustained. However, revisions to the inflation data shows underlying inflation a bit firmer in the last months of 2015 than previously reported.

"This was a firm, broad-based rise in core inflation that should dispel the notion, evident in market-based measures of inflation compensation, that the economy can't generate any inflation," said Omair Sharif, rate sales strategist at SG Americas Securities in New York.

Following the strong core CPI reading, the Fed's preferred personal consumption expenditures (PCE) price index (data next Friday), excluding food and energy, is now expected to increase 0.2 percent in Jan after slipping 0.1 percent in Dec. The core PCE is forecast rising 1.6 percent in the 12 months through Jan after increasing 1.4 percent in Dec.

Global growth slowdown and turbulence in markets are further dampening hopes of economic recovery in the eurozone and this is feeding into lower inflation expectations. The minutes of the ECB's January meeting showed that growth and inflation risks were already on the rise in the euro area and some policymakers are advocating pre-emptive action in the face of new threats. The market is already pricing aggressive easing from the ECB and a Fed on hold until 2017.

EUR/USD has retraced a bit following the sharp rise recently. This is a natural response to a turn in risk appetite, as the EUR is acting as a funding currency and tends to weaken when sentiment turns more positive. Relative rates have also moved a bit in favour of the EUR compared with the USD. EUR/USD is likely to trade higher in the medium term. The major was trading at 1.1056 as of 1130 GMT.

Lower inflation expectations could trigger central bank actions

Monday, February 22, 2016 11:50 AM UTC

Editor's Picks

- Market Data

Most Popular

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices