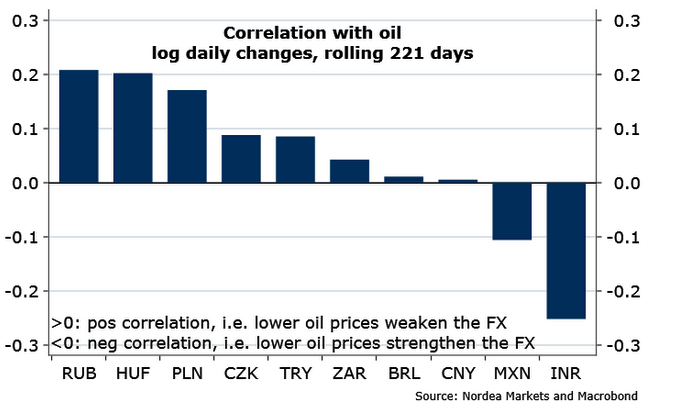

Oil prices have come under renewed pressure as Iran has sealed a deal with six world powers that would allow it to export oil again on an already oversupplied world market. The EM commodity currencies, such as the RUB, BRL, ZAR and MYR, will likely take a large hit. On the other hand, net commodity importers will see their FX gaining due to cheaper import costs.

The major factors of the RUB dynamics in order of importance are: the oil market, geopolitics and sanctions, CBR policies and capital outflow. Commodities account for 80% of Russian export. So it goes without saying that the pressure on the RUB may increase if the commodity market drops. The commodity market remains the major driver for the currency and the RUB may appear to be very vulnerable.

Lower commodity prices and structural slowdown in China, one of the main export markets for Brazil and South Africa, imply worsened external conditions for both countries. Both economies are already struggling with weak (or negative) growth this year, and large current account deficits, leaving their currencies fragile. Worsening terms of trade are likely to require FX weakness to get external balances back into a better position.

A renewed dip in oil prices wouldn't be beneficial for the MXN. Oil constitutes just over 5% of total exports and about 35% of fiscal revenues. This implies the economy will have to adjust to the new "low for long" oil price environment by finding another source of revenue. Lower oil prices are also putting expected investment inflows to the opened-up energy sector at risk. However, despite being affected by weaker commodity prices, the MXN is not as directly affected by slower China growth, the importance of the US being greater for Mexico.

A Malaysia and Indonesia are net commodity exporters, the MYR and IDR may come under renewed pressure if commodity prices plunge further. The MYR is highly correlated to palm oil prices, which in turn move together with crude oil prices. Indonesia exports both palm oil and metals so it is very sensitive to demand from China, which consumes about half of the world metal production.

Asian economies have become more sensitive to China. Thus, most Asian currencies will likely weaken if the China risk scenario increases. On the other hand, a prolonged slowdown in China will put downward pressure on commodity prices, which may benefit the Asian currencies, as most countries are net commodity importers, says Nordea bank.

Lower commodity prices to largely hit the Emerging Markets

Wednesday, July 15, 2015 7:28 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed