EURJPY demonstrates the highest beta to Euro-turmoil for the obvious reason that both legs of the cross pull in the same direction during stress. The GFC period is deliberately excluded from the analysis assuming that a global shock on that scale is unlikely to be repeated; its inclusion does not alter currency rankings but does amplify the magnitudes of elasticities in both directions.

Last week, Bank of Japan’s board members find easy monetary policy as the best way to go for in near term. The board believes that the inflation target of 2% is yet to be achieved since consumer price growth is under pressure.

Bank of Japan Governor Kuroda on Tuesday declined to comment on what the appropriate level for the yen is, saying foreign exchange policy is decided by the finance ministry.

Kuroda, who spoke in the lower house of parliament, also said the BOJ's purchases of exchange-traded funds are intended to meet its 2 percent inflation target and do not distort the price mechanism for stocks.

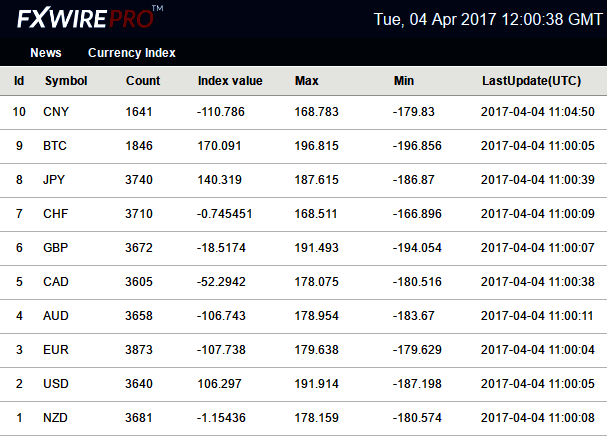

Consequently, after Kuroda’s speech FxWirePro currency strength index that measures the price performance of a basket of currencies on hourly basis indicates the robustness of Yen, while euro was struggling in a feeble mood (while articulating).

For more details on our index please visit below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

We raised our 1Q’17 GDP growth forecast to 2.5% QoQ SAAR from 1.0% after the strong IP report.

The unemployment rate unexpectedly fell to a 22-year low at 2.8% in February, but CPI inflation disappointed.

1Q consumption looks firmer than we had anticipated, but the trend looks soft.

Small-firms business sentiment jumped in March, partly reflecting seasonality at the end of the fiscal year.

Trade recommendations:

Buy 1Y vs sell 6M EURJPY 110 One-Touch puts, 0.758:1 notionals.

Buy CADJPY vs. sell EURJPY 1M ATM straddles, vega-neutral.

Sell 6M vs buy 1Y EURJPY 110 One-Touch puts, 0.758:1 notionals.

Buy CADJPY vs. sell EURJPY 1M ATM straddles, vega-neutral.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty