The outlook for UK activity in Q2 remains a key consideration in assessing the timing of the first hike in UK interest rates. Following comments from Martin Weale over the past week, the likelihood of a split vote at the August MPC meeting looks an increasing possibility.

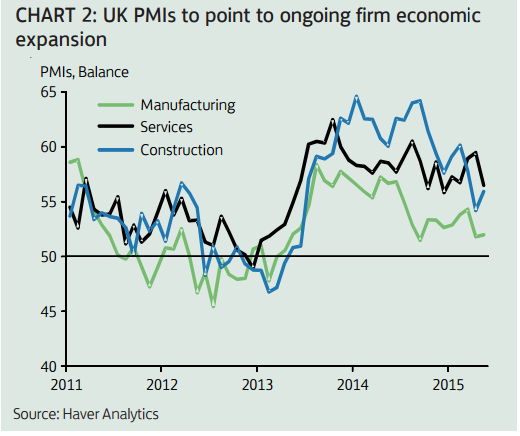

Following a sizeable softening in the UK manufacturing PMI in April, the recovery in May underwhelmed with a modest rise from 51.8 to 52.0. Evidence of a stronger tone of manufacturing activity in the eurozone in June - which we anticipate will feed through into UK supply chains - lends support to expectations of a further recovery, however.

"And, while the headline orders balance of the CBI Industrial Trends survey for June softened a little, the output expectations component remains at a solid level consistent with ongoing growth. Taken together, for June we expect the headline manufacturing PMI balance to firm a little further, rising to 52.4 in June from 52.0 in May." said Lloyds Bank

Despite an unexpectedly convincing outcome in the UK's General Election, service sector sentiment in May plunged to a four-month low, with the headline balance of the services PMI dropping to 56.5 in May from 59.5 in April. However, despite the marked weakness of the headline balance, the business expectations balance firmed to 71.5 from 71.1, while the employment balance was little changed.

"The weakness in the PMI has not been borne out in other surveys, including the CBI quarterly service sector survey. As such, some firming in the service PMI is likely, and we forecast a rebound from 56.5 to 57.3 in the June release." estimates Lloyds Bank

June PMIs to highlight the strength of the UK economy

Friday, June 26, 2015 5:34 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX