Japan's trade data for September released on 21 October posted a weak performance, suggesting a further downside risk to Q3 GDP. At this stage, however, it remains unclear whether this will be taken as a reason to ease further at the 30 October MPM. The markets also appear divided on the outlook for further easing on 30 October, but it is believed that any correction is likely to be small even if the BoJ stands pat, says Barclays.

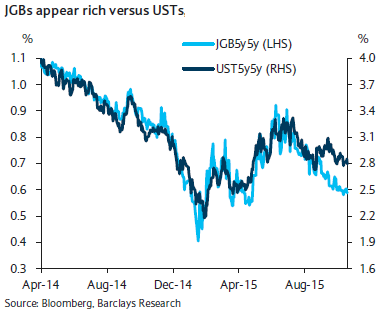

JGBs appear rich versus USTs, but JPY swaps look fair relative to USD swaps. This difference between the two is due to the rapid cheapening of ASW in the US since August. As shown in Figure 3, US ASW cheapening since August has had only a limited effect on Japan and the eurozone. It is probably more appropriate to view this as the impact of current government bond buying by central banks rather than expectations for the pace of such buying to increase as a result of further easing. If so, the richening of JGBs versus USTs shown in the above Figure may be the result of the BoJ's JGB purchases cutting off the effect of US ASW cheapening, states Barclays.

The decline in yields over the past several months is consistent with the global decline in yields, not something that specifically anticipates an increase in JGB buying as a result of further easing in October. Even if the BoJ stands pat, any reaction in JGBs and swaps are likely to be marginal, added Barclays.

Japan's trade data hints further downside risk to Q3 GDP

Monday, October 26, 2015 7:20 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed