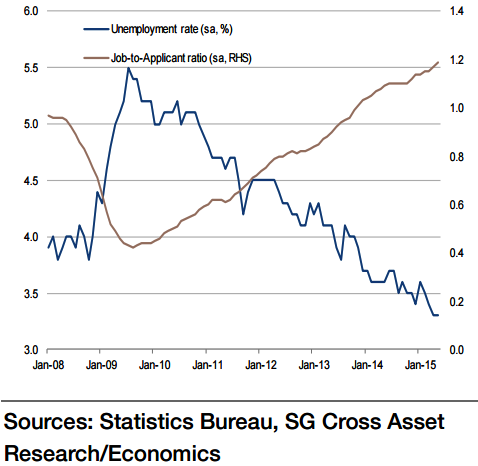

Both the manufacturing and non-manufacturing sectors are feeling the labour shortage, and are stepping up hiring. The unemployment rate is expected to continuously remain below 3.5%, corresponding to the NAIRU level.

"This in turn should underpin sentiment just as aggregate wages start to expand, thus enabling Japan to make a full exit from deflation. However, if thissituation fails to materialise, the BoJ's 2% price stability target will be difficult to achieve", says Societe Generale.

The unemployment rate needs to fall below 3% for the target to be met, but this level currently seems very far away.

"The job-to-applicant ratio is likely to remain at 1.19 in June, the highest level since 1992. This indicates companies' continuous willingness to increase hiring", added Societe Generale

Japan's job-to-applicant ratio to remain strong in June

Thursday, July 30, 2015 5:55 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022