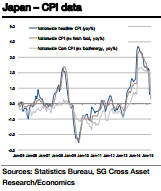

Japan's nationwide CPI (excluding fresh food) probably remained flat in May from a year ago (0.0% yoy), marking a significant slowdown from the +0.3% yoy observed in April.

There was a direct impact of 0.3pp on May CPI due to lag on certain price changes in April 2014. This effect will drop out of the annual rate in May 2015.

Factors such as a pickup in oil prices, the passing-on of price increases to products as a result of cost-push inflation caused by yen depreciation, and the recovery in domestic demand are pushing up inflation.

Since April the effects of the upward pressure on wages have been getting stronger. Downward pressure on prices due to the fall in oil prices will fade out after Q3. However, CPI is only expected to reach around +0.5% yoy by year-end.

"Domestic demand expansion resulting from wage increases and further yen depreciation should push up inflation to around +1.5% in 2016. Meanwhile,

Tokyo CPI (ex fresh food) is expected to remain unchanged at +0.2% yoy in June", says Socgen.

A modest inflation rate and a firm wage increase should enable real wages to increase, which in turn should increase consumption. However, this will still not be enough to reach the 2% price stability target on a sustained basis.

Japan's Consumption Tax hike effect drops out of annual rate – downside risks to rise towards summer

Monday, June 22, 2015 11:10 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed