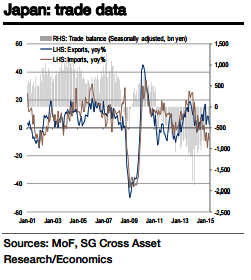

As oil prices have fallen rapidly, the terms of trade are improving, leading to a shrinking trade deficit as a trend.

As exports were weak last year, export growth this year will be prominent due to the base effect. However, as the economic recovery in the US and China remains weak, so too does the recovery in exports.

According to Societe Generale,

Looking ahead, previous yen depreciation will not only push up corporate profits but also Japanese exports in volume terms, especially as the US economy is likely to recover. Against this backdrop, the trade deficit is likely to continue to shrink.

However, the temporary fall in oil prices has ceased and the recovery of domestic demand will likely to support import growth. Thus, it will still take some time before the trade balance can be reached on a sustainable basis.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed