Indonesian imports growth is expected to ease through this year compared to last year as lagged impact of Rupiah depreciation will start to take effect, in addition to lower oil price, according to the latest research report from DBS Economics.

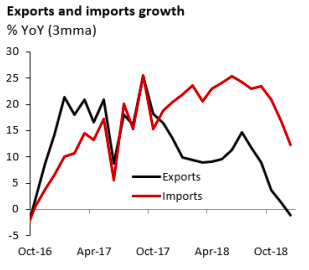

Worsening trade balance is the biggest risk; despite declining oil price, the trade deficit will still likely widen to USD4.6 billion in Q4 2018 from USD2.6 billion in Q3 2018. Imports have eased significantly in December 2018 to 1.2 percent y/y from 11.8 percent y/y in November last year, but not enough to compensate the contraction of exports, recording -1 percent y/y in Q4 2018 from 9.5 percent y/y in the first three quarters.

Yet, the risk of exports slowdown might remain on the horizon despite the more competitive Rupiah as China and overall global trade demand fall. In fact, exports to China has already contracted significantly starting in November 2018, averaging -0.1 percent y/y from 33.5 percent y/y between Jan-Sep.

Even though terms of trade have improved with lower oil price, trade deficit might stay wide as the difference between imports and exports volume growth becomes wider. There are no short-term solutions to close this imports-exports gap. Industrialization plan to develop export-oriented industries would be beneficial in the medium run, the report added.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed