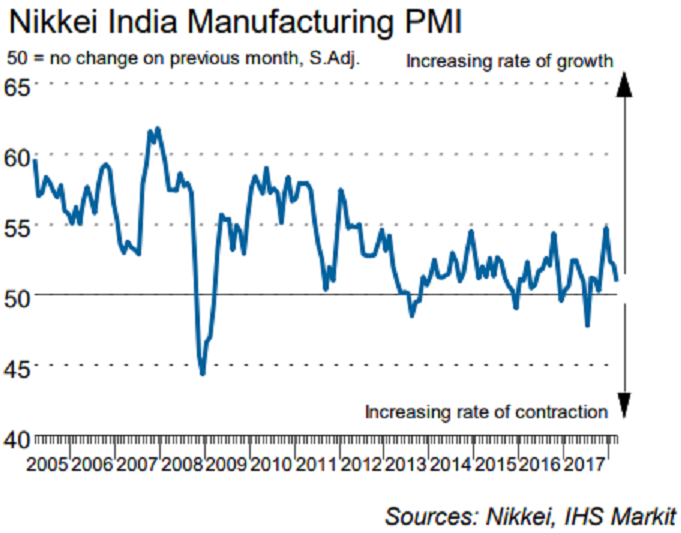

India’s manufacturing conditions improved for the eighth consecutive in March, but at the weakest pace since October. This reflected softer expansions in new work and output and a decline in employment for the first time in eight months. On a positive note, the recent build-up of inflationary pressures eased in March, with softer increases in both input costs and output prices recorded.

The Nikkei India Manufacturing Purchasing Managers’ Index (PMI) fell from 52.1 in February to a five-month low of 51.0 in March. This indicated the slowest improvement in operating conditions recorded by the survey since last October.

Indian goods manufacturers raised their output for the eighth successive month during March. Higher production was mainly linked to new order growth and favorable demand conditions. However, the degree to which output rose was modest and the weakest since October. Growth was reported across all three broad market groups, led by consumption goods.

March saw a further increase in input costs. Although marked overall, inflation moderated from February’s recent peak and registered below the series trend. Respondents commented on greater demand for raw materials, with prices for chemicals and steel reportedly up since February.

Indian manufacturers raised their output charges in March, thereby extending the period of inflation to eight months. Survey respondents attributed a rise in selling prices to the pass-through of higher cost burdens to clients. However, partly reflecting slower cost increases, output charge inflation was marginal and the weakest in the current sequence.

"Lastly, business sentiment remained weak in the context of historical data reflecting some concerns regarding business prospects over the next 12 months. Indeed, amid a slower expected pace of recovery in consumer spending, IHS Markit marginally downgraded its real GDP forecast to 7.3 percent for the fiscal year 2017-18," said Aashna Dodhia, Economist at IHS Markit and author of the report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination