India's monsoon season may be at least a month away, but storm clouds are already gathering over the Indian rupee (INR).

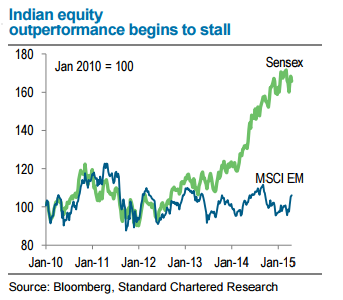

The powerful out-performance of Indian equities relative to those of other emerging markets has finally shown signs of stalling and heavy foreign inflows to the equity market from overseas have begun to abate.

Monday's USD 227.3mn net sale by overseas investors was the largest one-day liquidation since early January (albeit followed by new inflows on Tuesday). Strong portfolio inflows have been a key driver of the INR's robust performance in the past year.

Total portfolio inflows to debt and equity markets have averaged USD 11.2bn per quarter since April 2014. These inflows tend to slow on seasonal grounds in the April-June quarter, but there may be more substantial triggers for faltering capital inflows.

While optimism about the growth impact of India's policy reforms is likely warranted, anecdotal evidence suggests that the recent domestic growth picture remains rather subdued.

Moreover, merchandise exports have been persistently disappointing in recent months - exports fell 21.1% y/y in March, leaving the Q1 decline at 15.8% y/y.

India's equity-market out-performance has stalled amid softer India export data

Wednesday, April 22, 2015 1:22 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX