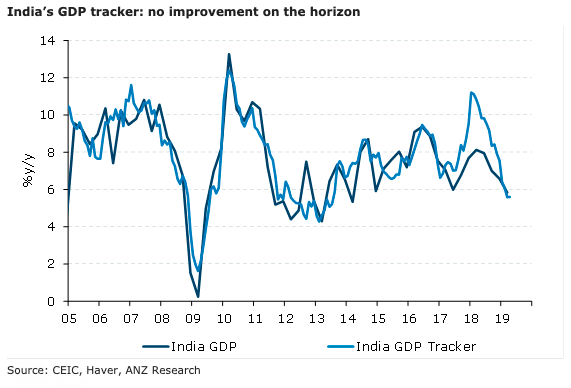

In line with the weakness in Q4 FY19 (quarter ending March 2019) GDP print, India’s FY20 GDP growth is expected to be even slower at 6.5 percent y/y, according to the latest report from ANZ Research.

The general activity and consumption indicators show no let-up. Investment indicators provide some green shoots (like credit to industry and investment proposals), a sustained recovery is however, missing.

The growth slowdown, amid weakness in demand pull inflationary pressures is likely to see the Reserve Bank of India (RBI) cut rates further this year, with expectations of a further 75bps of cuts in the next six months.

However, the bigger risks to this view come from a continued slowdown in manufacturing and consumption indicators and trade-related uncertainties which could impact the export outlook.

While the adverse effects of India’s relegation from the GSP (Generalised System of Preferences) programme will likely be limited given its low coverage, an escalation (India has retaliated with higher custom duties on 28 US products) could be unsettling, the report added.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens