Inorder to increase inflows to India , the government has taken many steps in a major liberalisation of FDI regime. 15 sector's FDI regulations have been eased, limit on Foreign Investment Promotion Board(FIPB) is extended to INR50bn from INR30bn. These changes will lead to quicker FDI approvals, also by reducing paperwork.

Rules on FDI have also been diluted in wholesale and retail activities, defence sector, private banks and construction sector, helping improve job creation, boosting the sectors.

Capital account signals will be further opened up, which indicates government's willingness to undertake reforms, besides political setbacks recently.

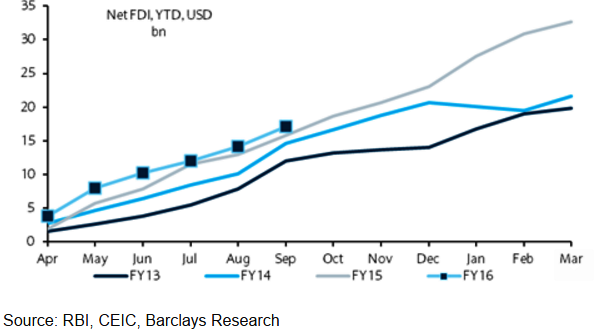

Government has been easing FDI regime since it took powers, USD17.1bn of net inflows are seen in first half of 2015, last year net FDI was USD 32 bn, following a series of liberalisation steps since September 2015, when Government in conjuction with Reserve Bank, announced opening of bond market to greater foreign paarticipation.

Indian government also started a bankruptcy draft code, with further fiscalisation of oil price profits by indirect taxes.

"The challenge remains in getting parliamentary approvals for key tax reforms such as the Goods & service tax, which requires two-thirds majority approval from both houses of parliament", says Barclays in a research note.

Indian government takes major FDI liberalization moves, key reform approvals remains a challenge

Wednesday, November 11, 2015 5:37 AM UTC

Editor's Picks

- Market Data

Most Popular

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength