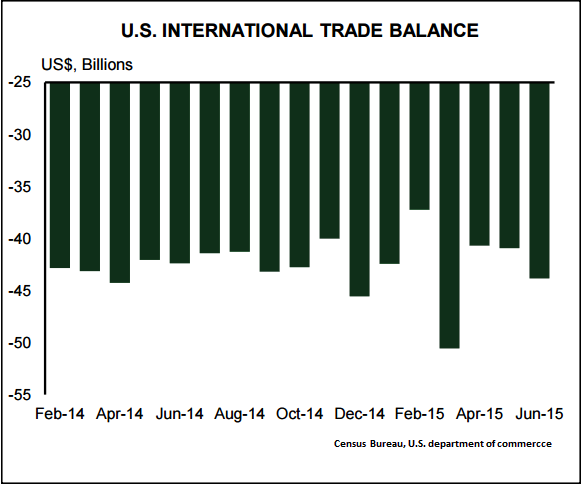

The US trade deficit is projected to turn down remarkably in July, narrowing to $41.81B from $43.84B the month before, with import activity falling on account of falling energy prices while export activity should rise modestly. This will mark the first improvement in the deficit since April.

Earlier post was up about $2.9 billion from $40.9 billion in May, revised. June exports were $188.6 billion, $0.1 billion less than May exports. June imports were $232.4 billion, $2.8 billion more than May imports.

But this time, export activity should rise on the month, posting a 0.4% MoM advance, bolstered in large part by improving global demand. Import activity is likely to decelerate by 0.55% MoM in July as the continuation of the decline on oil prices dampens the import bill.

In the coming months, we expect the improvement in the trade balance to be sustained as lower energy prices continue to keep the energy import bill low, but expect a stronger USD to weigh on exports.

Release Date: September 3, 2015 June Result: -$43.8B TD Forecast: -$41.8B Consensus: -$44.5B.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election