The International Monetary Fund (IMF) has remained wary over the medium-term growth outlook of advanced economies, besides, foreseeing financial risks in China, at the IMF’s annual meeting. The forecast of financial risks emerging in China has called for the authorities to take immediate steps to address the vulnerabilities.

Meetings on emerging markets were generally more positive, especially for key emerging markets such as Russia, Mexico and Brazil, as the countries are pursuing relatively orthodox and prudent macroeconomic policies, boosting an economic recovery. The IMF seems clearly concerned about increasing financial risks in China. While it does not see an immediate crisis, there is an urgent need that the Chinese authorities take steps to address the vulnerabilities Danske Bank reported.

In addition, the supreme monetary authority sees a two-speed economic development in Africa currently. The continent’s big commodity-producing countries, Nigeria, Angola and South Africa, are struggling and need structural adjustment to cope with the ‘low for longer’ outlook for commodity prices.

However, in oil-importing African countries, economic growth continues to be solid, due to the expansion of public investment, regional integration and population growth; notably, Kenya, Tanzania, Rwanda and Uganda are doing particularly well, the report added.

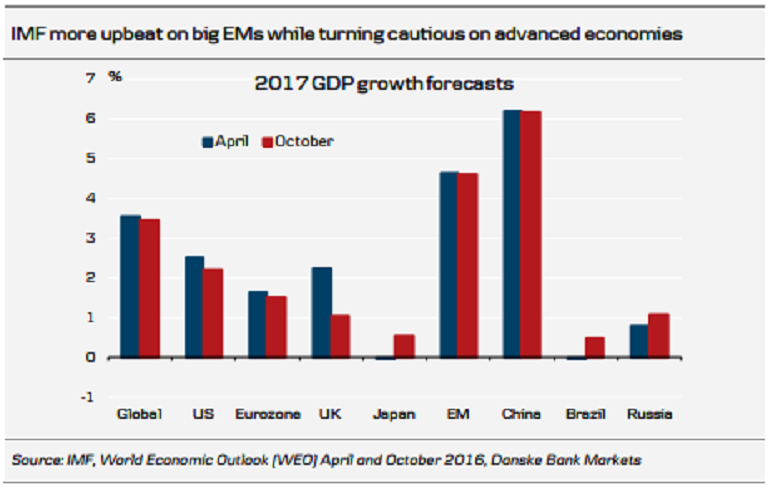

The outlook for the global economy points to subdued economic growth. Emerging markets are dominating the world economy increasingly. Indeed, the main reason behind the increase in global growth over the next five years is the increasing weight of relatively fast-growing emerging markets. There are fewer worries about China in the short term but more concerns about the medium term. Advanced economies will only contribute very remotely to the pickup in growth.

Further, low inflation presents a significant challenge to policymakers in advanced economies. The decline in inflation goes beyond the commodity price fall. Persistent economic slack also plays a significant role in pushing down inflation.

Meanwhile, a study by the IMF finds demand and its composition explain 80 percent of the slowdown in trade over the past few years; importantly, the sluggishness of investments in recent years, which is typically quite trade intensive compared with consumption, the report further noted.

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence