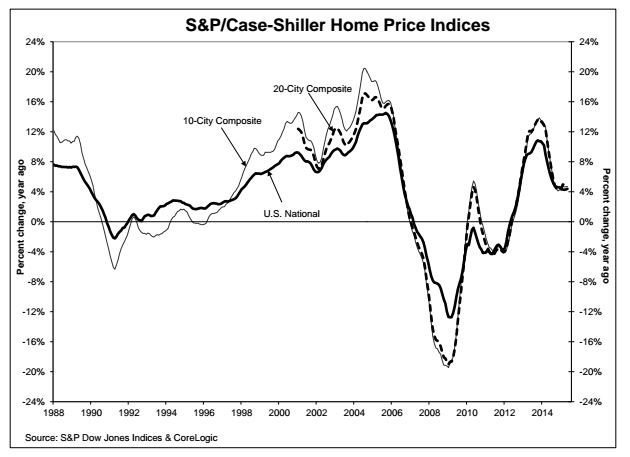

Average prices in the top 20 US cities were up 4.9 per cent in May from a year earlier, unchanged from April, according to the latest measure by S&P/Case-Shiller.

However, prices might drop in the coming months as FED chair Janet Yellen pointed out that many first time home buyers are not being able to manage affordable mortgage. Earnings growth as of now is not strong enough to counter the high cost of new homes.

In near past though average prices of new homes have fallen whereas demand for existing homes have gone up.

Shortage of new buyers likely to pose liquidity problems for existing home owners and result in a dysfunction in the market.

According to a research by New York FED, major concern for first time home buyers is not the mortgage rates but initial down payment. So it is unlikely to cause head winds for FED for rate hike this year.

It is up to the regulators, whether or not to tweak the requirement.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary