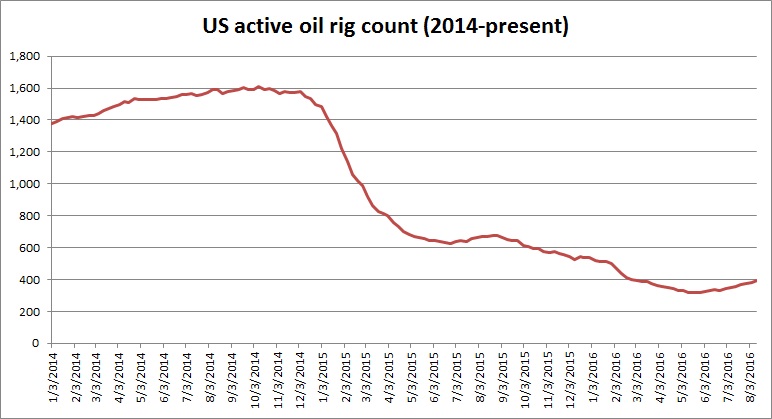

The number of active oil rigs in the United States edged up for an eighth consecutive week to 396. The number of active rigs has climbed more than 25 percent after declining to its lowest point in May this year. Still, the number of operating rigs is down more than 75 percent from their peak in October 2014.

While the number of rigs has started declining from October 2014, the US production kept on increasing and reached the peak of 9.59 million barrels per day in June 2015. Since then it has declined more than a million barrels to 8.48 million barrels in July this year. Since then it has somewhat stabilized around this level.

Since the oil price began its decline the U.S. shale oil producers have been cutting their cost of production and now this increase in the number of rigs, despite the oil price hovering below $50 per barrel indicates that they could have been very successful in cutting the cost of per barrel of production. Over the past years, due to their ability to start and close a well relatively at a cheaper cost, the shale oil producers have been named as the swing producers.

These increases in the operating rigs would be very troublesome for global producers as it means the Shale oil from the U.S. has become competitive enough to pose challenges to OPEC and Russian crude. WTI crude is currently trading at $44.6 per barrel and Brent at $2.4 per barrel premium.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed