Greece faces a too-close-to-call election on Sunday and the results could well result in a hung parliament despite assurances to the contrary. The election was called when Prime Minister Alexis Tsipras resigned his post on August 11th in an effort to weed out rebels within his Syriza party (itself rather rebellious) who were destabilizing government efforts to implement the bail-out agreement reached with Europe. Since Tspiras has so vocally ruled out a coalition with his main opponent - New Democracy - it is unclear which party will be able to form a coalition with weaker partners.

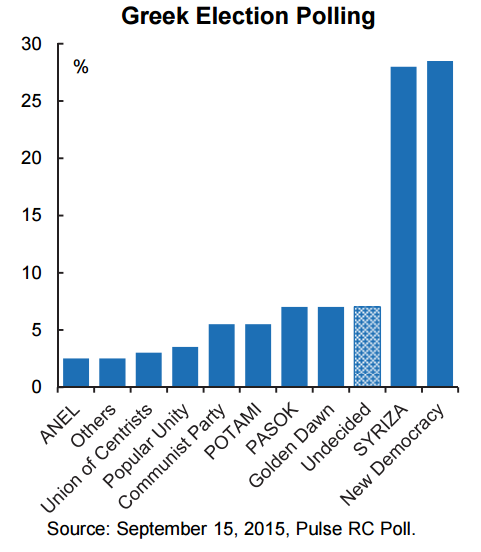

That said, the results could well surprise and hand a clearer victory to one or the other of the two main parties, but the more likely outcome is a minority coalition government and one that may take time to assemble. Note that Syriza's current polling is about six points lower than it was in the January 15th election while New Democracy's is about three points higher and PASOK is also polling a little higher.

The issue is whether the resulting government will be able to effectively implement the bail-out agreement or, worse yet, whether this election settles anything or another election lies ahead. It probably continues to remain valid to argue that Greece's significance to contagion risk across Europe is not what it was a few years ago thanks to ECB policy actions and the risk of further action to come, but one should remain cognizant of the risk of a Greek exit and whether it's correct to argue that markets would treat it as a special case and not get fussed over the precedent.

One person in particular will be hoping that this issue goes away for the better before he speaks. Mario Draghi will provide his regular quarterly testimony before the Committee on Economic And Monetary Affairs of the European Parliament on Wednesday. Recall that at the September 3rd ECB meeting, Draghi noted "The Governing Council will closely monitor all relevant incoming information. It emphasized its willingness and ability to act if warranted by using all the instruments available within its mandate and in particular recalls that the asset purchase program provides sufficient flexibility in terms of adjusting the size, composition and duration of the program." Thus, the risk is that Draghi further reinforces a willingness to do more if European inflation continues to disappoint or if Greece poses greater than anticipated risks especially to peripheral Europe.

Greece faces a too-close-to-call election on Sunday

Thursday, September 17, 2015 10:44 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed