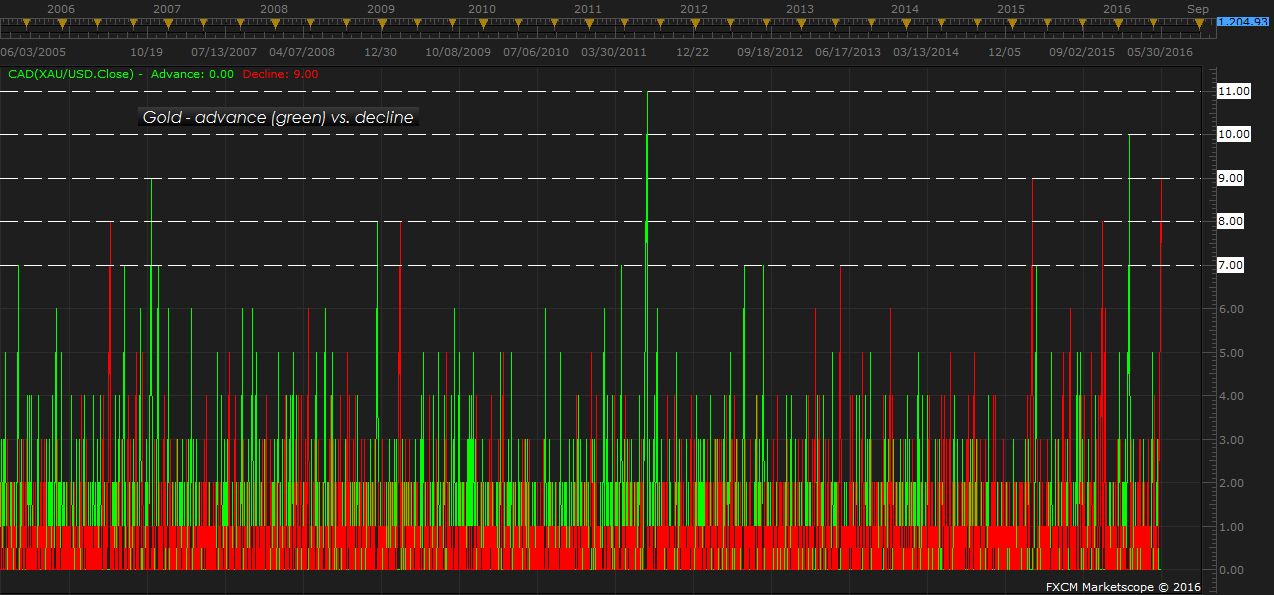

Gold has been declining and declining hard. The yellow metal, which had one of its best starts to a year in 2016, has declined for 9 consecutive days, including today. In past nine sessions, it has declined 5.4%, which is biggest since summer of 1981, when gold declined for 9 consecutive days, leading to a total decline of 13.45%.

Such long decline are not so common however, suggesting that a chance of bounce back is very high. In last four decades, there has been only four instances when gold declined for 9 consecutive days and four times, when gold declined for 8 consecutive days.

Current yellow metal rout has begun in May 18th, as many FED officials came out suggesting rate hikes in nearer future, as early as June and FED minutes indicated the same.

We, at FxWirePro, remain a gold bull in the medium term and expects the yellow metal to rise as high as $1600 area, however we mentioned many a time that unless $1350 resistance holds, there is a risk that gold could fall back to as low as $1000/troy ounce.

Current environment of stronger Dollar and rising equities do not do much good to Gold.

Biggest and strongest resistance for Gold is around $1180-1200 area, a break of which could lead to big decline.

Gold is currently trading at $1210/troy ounce.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022