After rallying relentlessly over the past year, bond yields rose sharply in Q2, led by Bunds. 10y German yields sold off about 5bp, to 1%, in a span of two months, pushing yields higher across other developed bond markets. According to Barclays, the violent move in European yields bore a closer resemblance to the 2013 taper tantrum than to a classic QE/reflationary trade.

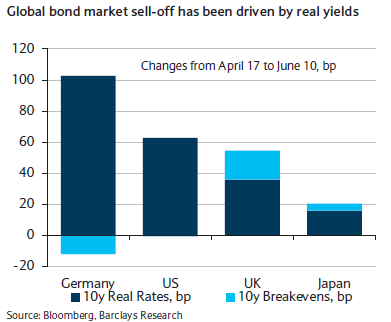

Figure shows that the entire rise from the mid-April lows has been real yield-driven; medium-term breakevens are essentially at beginning-of-year levels. Furthermore, the investor surveys suggest that wrong positioning and poor liquidity played the most important role in the sell-off, rather than a material rethink of the economic backdrop in Europe, notes Barclays.

A key distinction between the current sell-off in Europe and the US taper tantrum is that risky assets (EM, IG, high yield, etc.) have avoided a rout; this is likely because pricing for Fed hikes has continually been pushed out during H1, adds Barclays.

Global rates finding new equilibrium

Thursday, June 25, 2015 6:01 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX