Global real GDP growth is expected to go from 3.6 percent in 2017 to 3.8 percent in 2018, then 3.9 percent in 2019. A trade war at this point is not factored in, but the arduous renegotiations of the North American Free Trade Agreement (NAFTA), the proliferation of U.S. protectionist measures and possible countermeasures against them add a lot of uncertainty to our economic forecasts, according to a recent research report from Desjardins.

The U.S. economy should accelerate in 2018, especially starting this spring, driven by the tax cuts announced at the end of last year, as well as increased government spending. Real GDP is expected to grow 2.8 percent this year, with 2.5 percent growth forecast for 2019. The Federal Reserve seems certain to raise its key rates again on March 21 and could signal a few more rate increases for the coming quarters, while continuing its gradual approach.

Canada’s economy expanded 3.0 percent in 2017 and should slow to a more sustainable pace in 2018 and 2019, which should see a growth of 2.1 percent and 1.9 percent respectively. Ontario and British Columbia should be especially hard hit by the expected housing market slowdown. Key rates are still expected to rise gradually in Canada, but some signs of slowing in the housing market and household debt, and the heightened risks associated with U.S. protectionism could convince the Bank of Canada to wait until summer before tightening its monetary policy further.

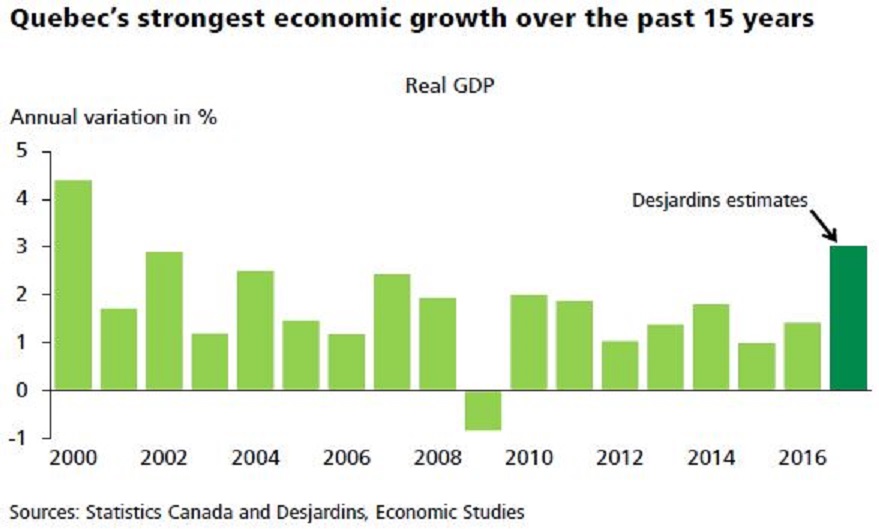

Household and business confidence is very high, the labour market is sound, and the housing sector remains active. However, it will be hard to keep up this pace following 2017’s estimated 3.0 percent growth, the strongest growth in about 15 years. Real GDP growth should slow to around 2 percent in 2018 and 2019, the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination