• EUR/NZD erased earlier gains on Thursday as pair eroded some of day's gains after hotter-than-expected U.S.CPI data.

• U.S. consumer prices increased more than expected in September as rents surged by the most since 1990 and the cost of food also rose.

• The pair came off session highs as the pair cut some of earlier gains after the initial shock.

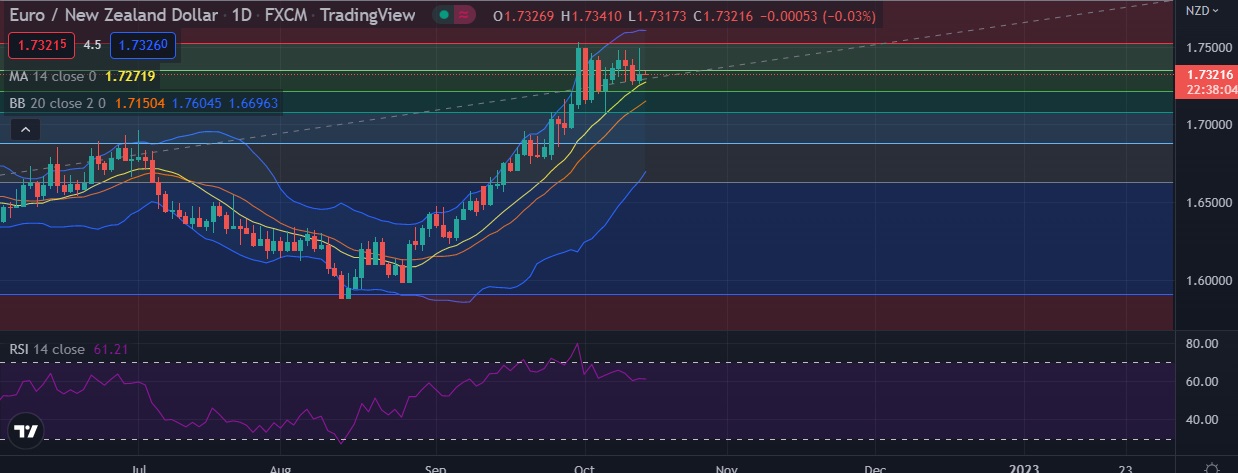

• Technical signals show the pair could gain more ground in the short-term as RSI is at 63 bullish, daily momentum studies 5, 9 and 11 DMAs are trending up.

• Immediate resistance is located at 1.7352 (38.2%fib), any close above will push the pair towards 1.7529(23.6%fib)

• Support is seen at 1.7275(14 DMA) and break below could take the pair towards 1.7218 (50%fib).

Recommendation: Good to buy around around 1.7310 with stop loss of 1.7210 and target price of 1.7450