Dear readers, we would like to run you through our recent write up before begin with this derivatives strategy, we can vouch for sure that this would give us the hints on trend directions of this pair.

Check out the article by clickiing here.

Well.., you may now be able to cope up with the perplexity of these puzzling swings after reading above article and compare the same with current swings.

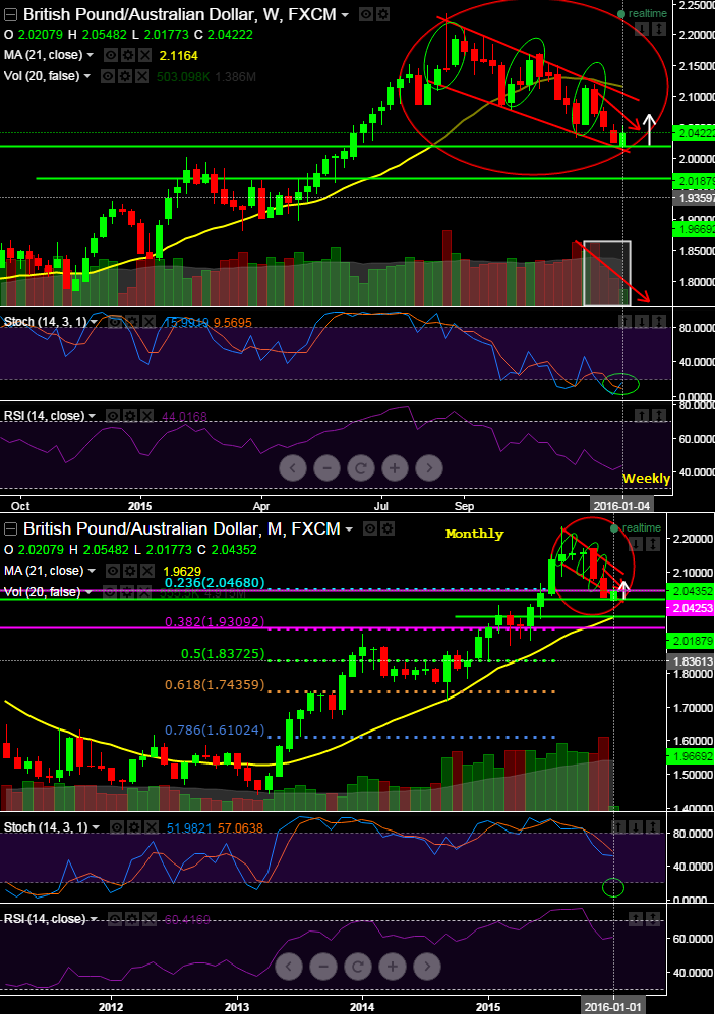

For now, on weekly graphs it has tested channel line support at 2.0187 to bounce back.

This bullish view is supported by volume contraction on rice declines as well (see grey shaded areas).

Currently, it looks like the minor uptrend is back again, which in turn these price gains could be deemed as recovery swings.

Following a sharp decline in the housing construction sub-index in November to 55.3, we now forecast construction PMI of the December series to overturn much of that loss, lifting the overall index to 56.1.

Hedging Perspectives: Option straps (GBPAUD)

Subsequently, those who deploy this strategy so as to speculate spot FX bullish swings and any abrupt slumps as well adding leveraging touch to the portfolio.

For now, the pair has pretty much responded as per earlier our bearish anticipation and no hesitation in foreseeing price bounces in near term again as the daily chart suggest some buying interest with least risky scenarios that would result in some price recoveries.

As a result, we recommend building portfolio with longs positions in 2 lots of 0.50 delta ATM calls with 1W expiry and there onwards 1 lot of -0.49 delta ATM puts of same expiries.

Hence, this GBPAUD straps strategy should take care of current upswings and any abrupt downswings, handsome yields possible on the upside.

One can also observe the rising delta effects upon rising exchange rate GBPAUD and shrinking as the underlying spot rate dips which means our underlying outrights are fairly hedged against irrespective of rate scenarios.

Delta of far OTM options is very small which is why we've chosen ATM instrument on call. 1-point movement in underling pair will not have much effect on the option premium.

FxWirepro: GBP/AUD diagonal straps to monitor puzzling swings on speculative basis

Tuesday, January 5, 2016 7:33 AM UTC

Editor's Picks

- Market Data

Most Popular