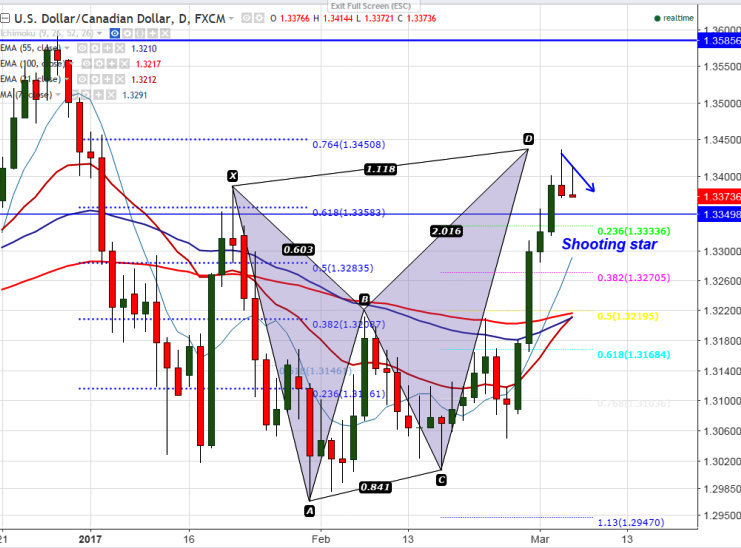

- Candlestick Pattern- Shooting star.

- Lonnie gained almost 279 pips in the previous week on account increasing probability of US Fed rate hike in Mar.

- BOC kept its interest rates unchanged at 0.5% on Mar 1st policy meeting due to “significant uncertainties” and lack of clarity over Donald Trump economic agenda.

- Policy divergence between U.S Fed and BOC has dragged the CAD further down in this week.

- On the higher side, 1.34369 will be acting as major near term resistance and any break above will take the pair till 1.3500/1.3600.

- The near term support is around 1.3330 (23.6%retracement of 1.30088 and 1.34369) and any break below targets 1.3270/1.3215 (100- day EMA).

It is good to sell on rallies around 1.3395-1.3400 with SL around 1.3500 for the TP of 1.3300/1.3275