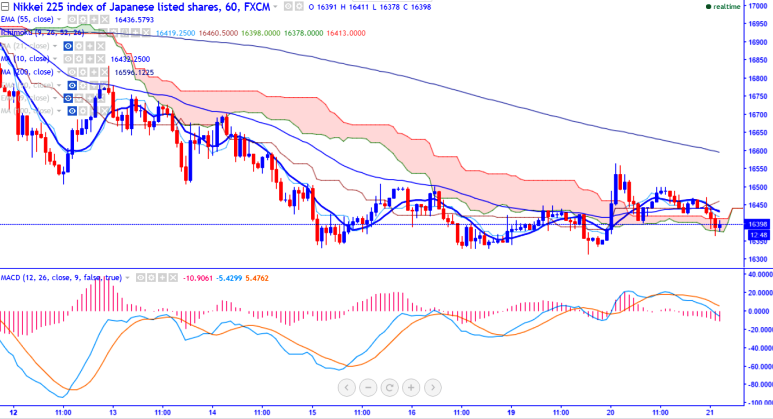

- Nikkei225 has declined after making a high of 16566 on account of stronger Yen.It is currently trading around 16393.

- The index is trading slightly below Tenken-Sen (16423),kijun-sen (16455) and also below 55-H EMA. So it should break above 200- HMA for further bullishness.

- Market awaits two major central banks BOJ and Fed meeting today for further direction.

- On the higher side, next immediate resistance is around 16598 (200-H MA) and any break above will take the index till 16718 (200-day MA)/16835.

- The major support is around 16260 (38.2% retracement of 14823 and 17159) and any break below 16260 will drag the pair till 16000.

It is good to sell on rallies around 16600 with SL 16800 for the TP of 166280/16040