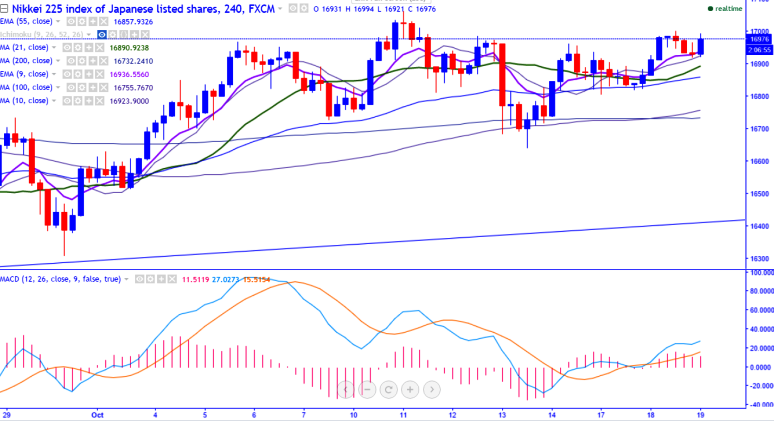

- Nikkei225 has made a steady gains after making a minor bottom at 16641 on 13th Oct 2016. Japanese index is rising sharply for the past two trading session on account of weaker Yen.It is currently trading around 16971.

- Technically in the 4H chart the index takes support at 55- 4H EMA and slightly jumped from that level.Short term weakness can be seen only below 16731 (200- 4H MA).

- On the higher side, resistance is around 17000 and any break above targets 17159 (Sep 2nd 2016 high)/17300/17500.Nikkei should break above 17159 for further bullishness.

- The major support is around 16850 (55- 4H EMA) and any break below targets 16730 (200- 4H MA) /16532 (200-day MA).

It is good to buy on dips around 16800 with SL 16700 for the TP of 17000/17160.