• GBP/AUD gained on Wednesday as the pair gained support after data pointed that British inflation hit a more than nine-year high last month.

• At GMT 22:43, the pair was trading up 0.08 percent at 1.8075 after reaching daily low at 1.7989.

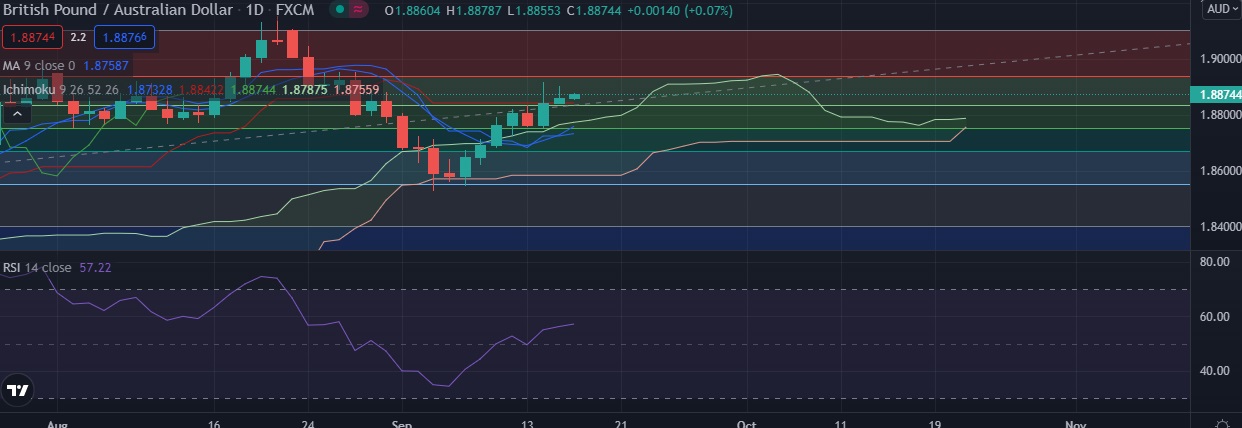

• Technical signals are bullish as RSI is at 58, daily momentum studies 5, 9 and 10 DMAs are trending up.

• Immediate resistance is located at 1.8939 (23.6%fib ), any close above will push the pair towards 1.9000(Psychological level).

• Strong support is seen at 1.8831(38.2%fib) and break below could take the pair towards 1.8781 (Ichimoku cloud top).

Recommendation: Good to buy on dips around 1.8870, with stop loss of 1.8800 and target price of 1.8950.