• GBP/AUD initially declined on Monday but recovered ground as market perceived value ahead of the BoE meeting.

• GBP/AUD reaches 1.8499 after pushing its recovery envelope from 1.8369. 1.8499 highest since 29th Oct 2020.

•The pair is approaching to break 23.6% retracement at 1.8502, a daily close above which will accelerate gains towards 1.8600 level.

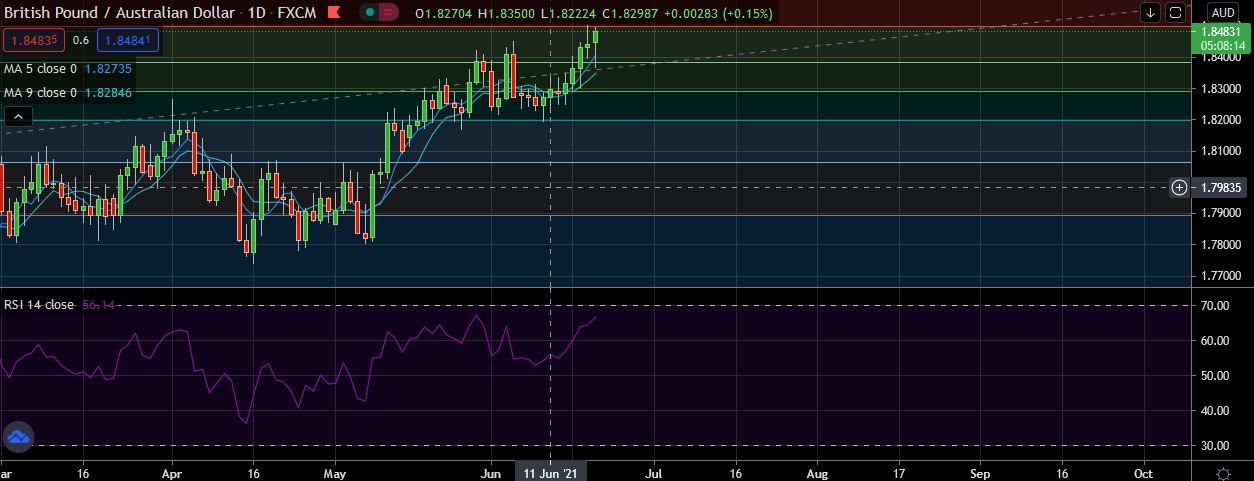

• From a technical viewpoint, the moving averages are pointing upwards, while the RSI is strongly bullish at 66.

• Immediate resistance is located at 1.8502 ( 30 DMA), any close above will push the pair towards 1.8527( 22nd Oct 20 high).

• Strong support is seen at 1.8410 (5DMA ) and break below could take the pair towards 1.8382 (38.2%fib).

Recommendation: Good to buy around 1.8460, with stop loss of 1.8350 and target price of 1.8580.

FxWirePro:GBP/AUD consolidating around 1.8480, bias is bullish

Monday, June 21, 2021 3:53 PM UTC

Editor's Picks

- Market Data

Most Popular