• EUR/NZD declined on Thursday as the pair attracted sellers after ECB reaffirmed its accommodative monetary policy stance.

• The European Central Bank raised its growth and inflation expectations on Thursday, but promised to provide stable stimulus over the summer.

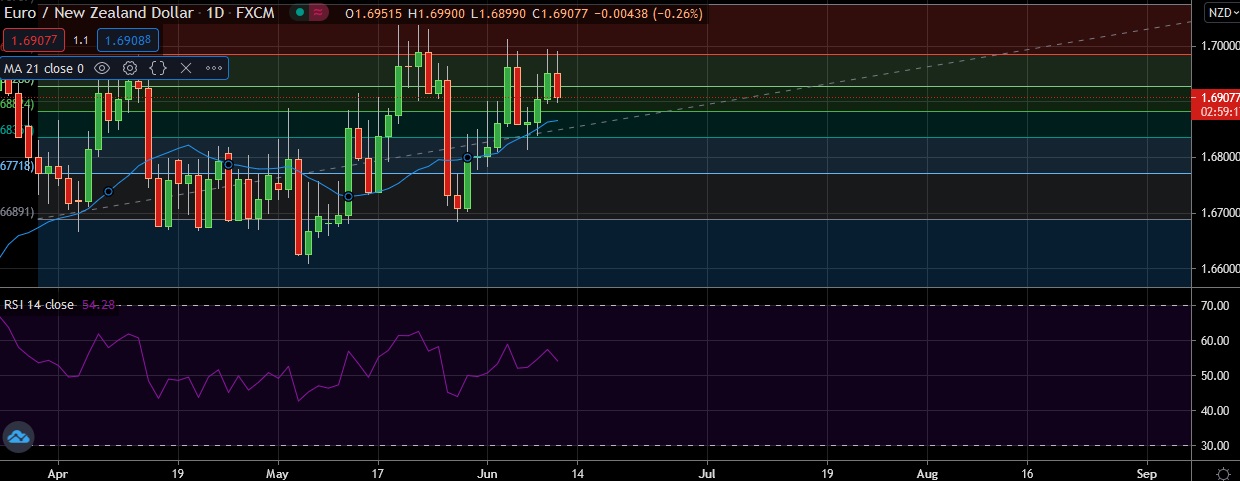

• The pair extended its drop to hit 1.6900 daily low, it was last down 0.16% at 17:51 GMT .

• The pair is approaching to testing 1.6884(50%fib ). A break under 1.6884 will unmask 1.6834 (61.8%fib )level in the short term.

• Immediate resistance is located at 1.6924 (38.2%fib), any close above will push the pair towards 1.6985 (23.6%fib).

• Immediate support is seen at 1.6898 (Daily low) and break below could take the pair towards 1.6882(50%fib).

Recommendation: Good to sell round 1.6900, with stop loss of 1.6970 and target price of 1.6830