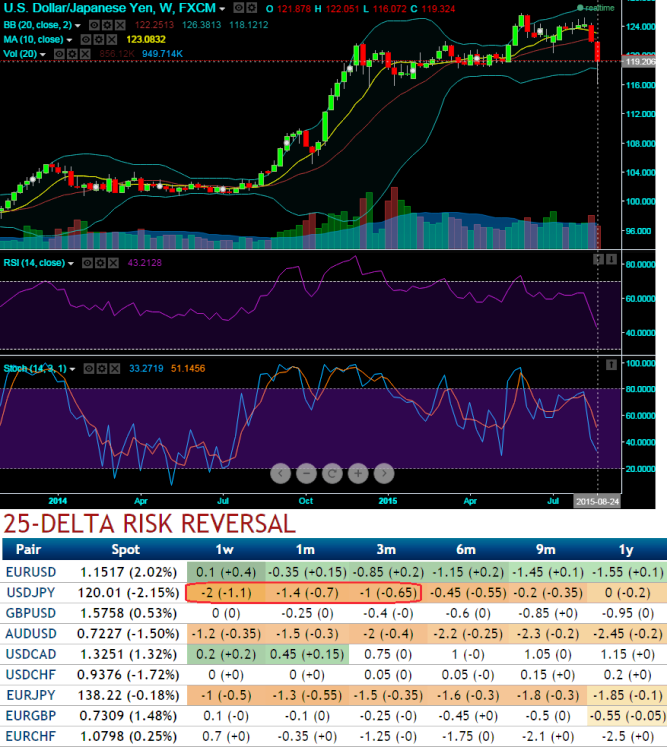

We kept reiterating that Yen to curiously get benefited from dollar, from last three consecutive weeks from the highs of 125.270 dollar has been losing upto 116.072 (this week's low).

Refer our earlier posts for more reading: http://www.fxwirepro.com/biz/admin/contents/breaking/popup.htm?id=692631

The puts in our straddles have served desired purpose of hedging and fetched unlimited returns for speculators.

Looking at the delta risk reversal of USDJPY, we understand 2 key factors,

- Selling sentiment is piling up in this pair

- Downside hedging costlier than hedging through call options.

In our opinion, it would certainly not be sharp spikes for sure until Fed's meeting, so keeping this in mind, at the money or out of the money call shorting is recommended as a speculation basis. Thereby, high premiums on call shorting can be certainly locked in as our return. The main objective of writing naked calls is to collect the premiums when the options expire worthless. One would write an out-of-the-money naked call every month and if USDJPY stays flat or drops from current spot at 119.090, one would pocket the premiums and repeat the process as long as the perceived market condition remains unchanged.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?