We reckon that it is premature to crown the dollar king and extrapolate continued broad USD strength into and through the second half of the year. Cyclical divergence, while still favouring the USD, is narrowing. As USDJPY was well anticipated for price spikes in short run, the pair has significantly risen from the lows of 104.629 levels to the recent highs of 112.420 levels amid the major downtrend, we’ve already advocated diagonal put ratio back spread about a fortnight ago.

Diagonal Put Ratio Back Spread as Volatility Trading Strategy Amid Bearish Scenarios:

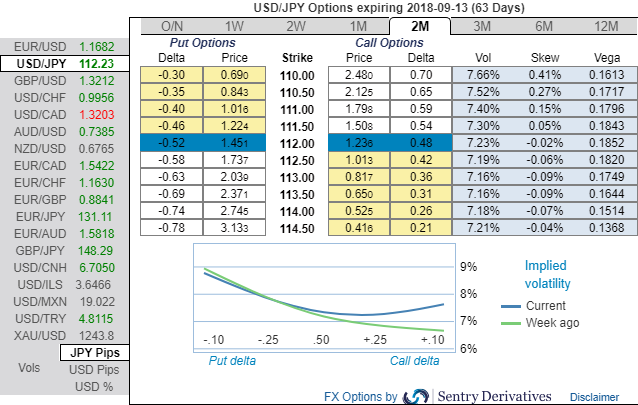

The execution: If you ponder upon cost effectiveness and wouldn’t like to divert exposure, we advocate buying USDJPY 2w/2m put ratio back spread strikes 112.634/110.595 (2 lots), (vanilla: 0.75%, spot ref: 112.330). A 2:1 put back spread can be implemented by buying a number of puts at a higher strike and buying twice the number of puts at a lower strike.

Rationale: The implied volatility of ATM contracts of USDJPY is trading back towards 7.01% and 7.66% for 2w/2m tenors respectively, as the positively skewed IVs of 2m tenors signify the hedging sentiments for the further downside risks over the period of time, this appears to be conducive for put option holders. On the flip side, it is wise to utilize abrupt rallies amid shrinking vols in the below-stated options strategy.

The positively skewed implied volatilities of 2m tenors signify the hedging sentiments for the further downside risks, this appears to be conducive for put option holders.

This bearish sentiment is substantiated by the mounting negative risk reversal (RRs) numbers, and negative RRs indicate the hedging sentiments for the bearish risks appears to be intact.

What makes strategy more attractive: Short leg (ITM shorts) of this strategy would have fetched attractive yields as the underlying spot FX has significantly spiked above, while long legs are yet to function having two months of expiry.

The short leg with narrowed expiry likely to benefit time decay advantage which in turn reduces hedging cost on the long leg of ATM put.

Currency Strength Index: FxWirePro's hourly JPY spot index has shown -115 (which is bearish), while the hourly USD spot index was at 58 (bullish) while articulating at 07:29 GMT. For more details on the index, please refer below weblink:

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation