KRW has depreciated by more than 3% versus USD since early June. As a result, the won has gone from being Asia’s best-performing currency in the first quarter to the worst performing in the second quarter.

This is in line with fresh signals that foreign investors are pulling back its investment from South Korea’s bond market, largely due to the speculations that the Bank of Korea (BOK) could become more hawkish in the second half of this year.

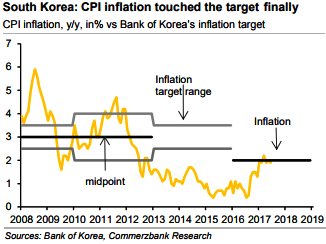

Korea’s economy performed steadily this year, and more importantly, CPI inflation has returned to 2%, touching the BOK’s target for the first time since 2013 (the above chart).

This sort of speculations has triggered profit taking in the bond trading positions.

EURKRW – USDKRW 2M ATM vol spreads. Sell 1Y 25D USD call/KRW put.

The short end is pricing in rate hikes while it is expected that unchanged rates will prolong by 2Q’18. The short end might be attractive to receive at these levels.

The upward move in USDKRW over the past month has probably run its course and a consolidation or reversal phase could ensue.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?