Shift policy dynamics leads euro vols market downside, shrinking IVs, skews and neutral risk reversals lure cheap bearish hedging:

Developments over the past week motivate two changes to our trade recommendations. First, we scale back our EUR longs since with the ECB meeting now behind us and modestly more dovish than expectations, a monetary policy catalyst for euro strengthening will be lacking in the coming weeks.

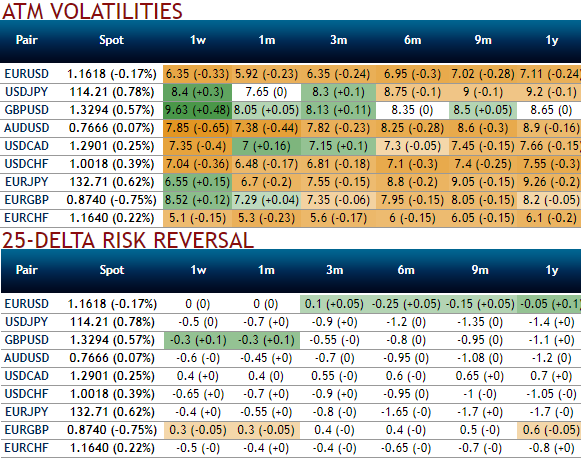

Before proceeding further, let’s glance through above nutshell evidencing IVs, IV skews and risk reversals of short-tenured ATM contracts of EURUSD. IVs have been shrinking away, these are the least among G7 FX pool, while risk reversals have been neutral. Positively skewed IVs are suggesting the neutral.

Euro downside volatility remains cheap Euro vol market could be more nervous. The vol sell-off can be attributed, at the very least, to the options market unwinding long gamma positions that were built ahead of the ECB meeting. But tactical positioning cannot fully justify such a sell-off because:

1) The fast euro move generated substantial realized volatility, and

2) One could expect the options market to be quite nervous with the spot testing its important horizontal support just above 1.16 (the upper bound of the 2015-2017 range).

No premium (yet) in sub 3m euro puts. Although the options market is now certainly much less confident that we can have imminent topside volatility (as reflected by the softest RR), market pricing is not switching towards substantial bearish risks.

Despite the euro fall, the RR did not return to negative territory and, noticeably, the implied volatility preserved its positive correlation with the FX rate by moving lower alongside it. (Only the 6m RR is priced more negatively because this tenor includes the Italian election expected in early 2018).

All in all, this is a frail equilibrium, and recent dynamics mean short-dated OTM euro puts are still a cheap hedge.

The expectation is for a second ECB policy pivot to be delivered in 2018 which should eventually drive sizable euro strength once again, but gains from this driver will be limited in the near term. In the interim, EURUSD will be more susceptible to US-specific factors which have more dollar bullish as noted earlier, as well as intermittent political risk in the Euro area.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts