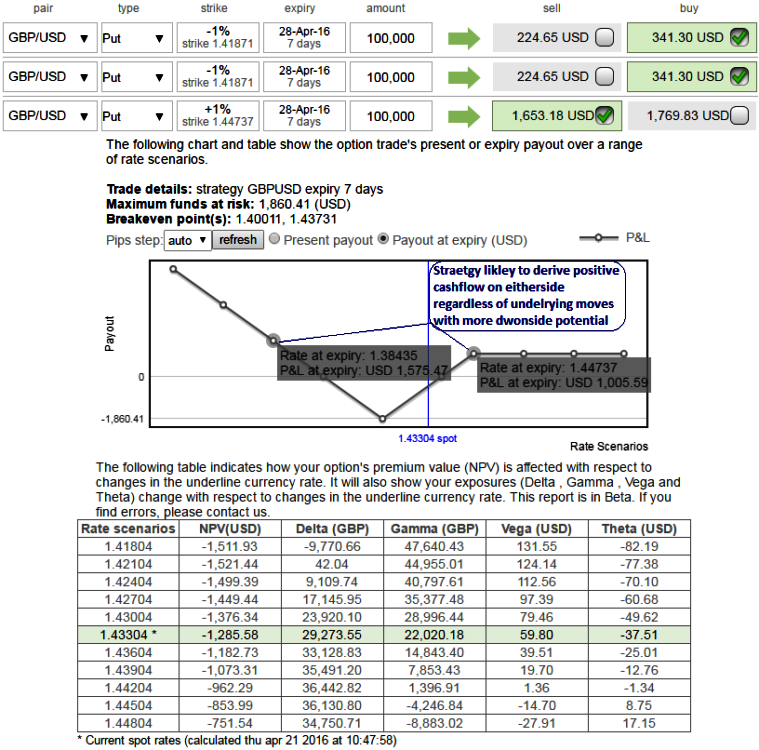

Suppose at current GBPUSD spot FX is trading at 1.4330, an options trader constructs a 2:1 put backspread by shorting 1W (1%) ITM put for $1654.39 and simultaneously, going long in 2 lots of next month (1%) OTM puts for $341.30 each.

Thereby net credit is taken to execute this strategy. Hypothetically, even if you select ATM strikes on long positions with comparatively healthy deltas, then the negligible net debit is required to enter this trade.

Scenario 1 (What if slumps substantially):

If GBPUSD spot drops below 1% OTM strikes on expiration in next month, all the options will expire in the money.

The short put is worth more than any other positions in the strategy and needs to be bought back to close the position. Since the two puts bought is now worth more, their combined value could either be equal to that of ITM put or more than that of ITM put as we have selected narrow expiries on short side.

So even if spot drops substantially within 1 week, just 1 lot is enough to offset the losses from the written put. Below BEP (Break Even Point) though, there will be no limit to the gains possible.

Scenario 2 (What if spikes adversely):

If GBPUSD spot rallies to ITM strikes that we have shorts on or higher at expiration within 1 week, all the options involved will expire worthless. Since the net debit to put on this trade is minimal or negligible, there is no resulting considerable loss.

Scenario 3 (What if remains between strikes):

On expiration after 1 week, if underlying spot FX is trading at 1% OTM strike value, both the long positions expire worthless while the 1W short put on 1% OTM strike expires in the money with intrinsic value.

Buying back this put to close the position will result in the maximum loss for the options trader.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX