AUDUSD remains in the middle of the USD 0.72 - 0.78 range that has held since mid-2016. The upside for the currency is indeed capped by the prospect of further narrowing in short rate spreads and a sense that the Australian economy is not performing as strongly as policy makers would probably like.

However, a move below USD0.72 in the near-term would require further escalation of China growth concerns and/or commodity weakness and a sense that the RBA has sufficient flexibility on the housing front to ease. As a result, AUDUSD is projected to decline further through 2017 on skinnier rate differentials and weaker terms of trade profile.

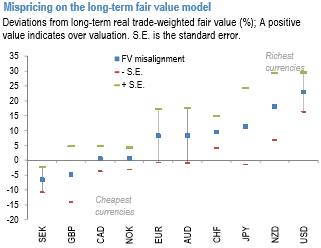

GBP has been in focus and has been the underperformer in G10 since our last publication in the run-up to the elections. The ranking hasn’t changed since our last publication, even though the dollar has continued to slide to make a new 6-month low on a TWI basis. Aussie and Kiwi dollar have still been the richest currencies, while SEK and GBP are still the weakest on the REER basis on this framework.

The valuation divergence has continued to persist in commodity currencies with NZD and AUD still screening rich vs. CAD and NOK. Valuations of petro-currencies are still near fair value (refer above chart), but still depressed from the long-run point of view.

CAD and NOK appear similarly near fair value but continue to appear quite cheap relative to Antipodeans (refer above chart), where valuations are still rich (refer above chart). NZD is the richer of the two currencies and appears richer-still given the outperformance in the past month.

Both currencies continue to face further downside in this framework as well in our forecasts, especially vs. EM high yielders as discussed in prior publications.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure