With the deterioration in the local Turkish political situation and a less supportive environment from higher G3 yields, the outlook for the lira is worsening, in our view.

While the CBRT could conduct FX sale auctions or release FX liquidity from its FX liabilities like it did last week, we think the impact of these measures would be modest, and so we do not expect the central bank to be particularly proactive with its toolkit to stabilize the lira in the interim.

Following on from the economic coordination board meeting last week, we continue to receive conflicting signals from different policy camps: yesterday, PM emphasized during a speech that lira movements have necessitated a policy response, he emphasized that CBT would decide on its own measures.

President Erdogan's economic advisor Bulent Gedikli that past sharp rate hikes are the very reason why Turkey finds itself in its current state. This could mean that while the economic coordination board chaired by PM Yildirim agrees that rate hikes could be necessary, there has been no such agreement with President Erdogan's camp -- that would limit how far CBT will be willing to go with its lira defense via rate hikes. Our base-case is that CBT will raise rates modestly on Thursday, but that this will not have a lasting supportive effect on the lira.

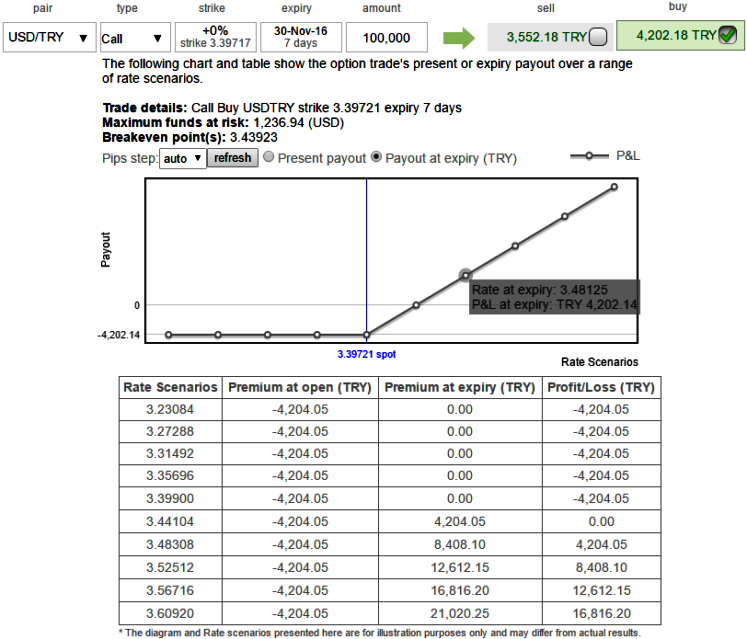

Please be noted that the ATM IVs of 1w and 1m are spiking crazily above 19% and 16.8% respectively. We find option exposures most attractive at present, with implied volatility and skew trading near their lowest levels in a year when we entered our USDTRY call on 7th November (USDTRY vol has recently spiked higher following the global risk-off after the US election results).

Going forward, the absence of local FX selling in the coming weeks could render USDTRY a lot more volatile than the market has grown accustomed to, in our view. The central bank has expressed concerns over the currency, suggesting it would not cut rates further without FX stability, but we doubt this is enough to stabilize the lira.

As a result, we recommend ATM +0.51 delta call options to mitigate further upside risks, why ATM contracts? Because the Vega is at its maximum when the option is ATM and declines exponentially as the option moves ITM or OTM. This is because a small change in IV will make no difference on the likelihood of an option far out-of-the-money expiring ITM or on the likelihood of an option far into-the-money not expiring ITM. ATM calls are far more sensitive since higher IV greatly increases their chances of expiring ITM.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis