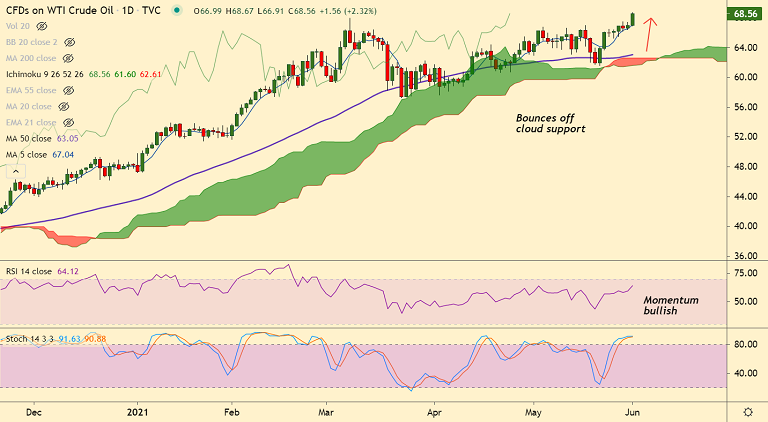

USOIL chart - Trading View

WTI crude oil prices spiked over 2.30% and were trading at $68.59 at the time of writing.

Oil markets were buoyed after the OPEC+ alliance forecasts a tightening global market ahead of a production policy meeting.

A robust recovery in the U.S. and Europe has given OPEC+ reason to believe that markets can absorb additional supply, should Iran nuclear deal be revived.

Further, OPEC Secretary-General Mohammad Barkindo said at a meeting on Monday that Iran’s comeback “will occur in an orderly and transparent fashion.”

He noted that the event will not upset the current stability that other OPEC+ nations have toiled to achieve.

Oil prices trade with a strong bullish bias. Momentum studies are strongly bullish. 200-month MA at 69.89 in sight.