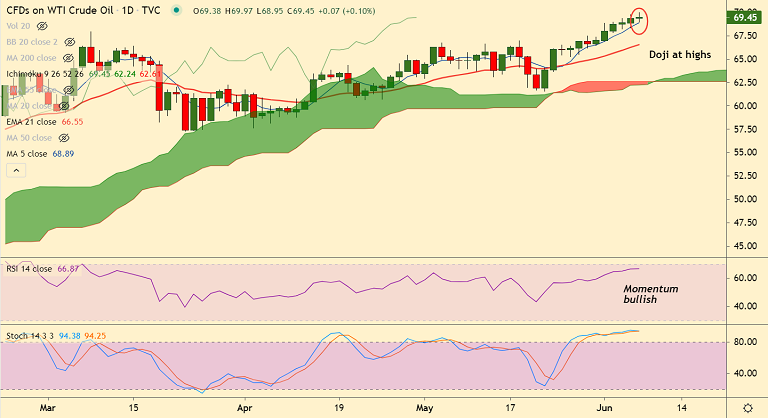

USOIL chart - Trading View

West Texas Intermediate crude hit fresh multi-month highs at $69.97 before retreating slightly to trade at $69.32 at around 11:00 GMT.

Oil prices under pressure amid signs of weakening demand from Asia with lower cargo arrivals in May.

Covid-19 resurgence in most of the South Asian countries, which depresses fuel demand in the continent.

Further, rebound in the US Dollar Index (DXY), adds pressure on the dollar-denominated commodity.

Technical indicators are bullish. However, the pair finds major resistance at 200-month MA at 69.89.

Doji formation on the daily charts suggests indecision among bulls to take prices higher. Decisive break above 200-month MA required for upside continuation.

On the flipside, 5-DMA is immediate support at 68.88. Break below could see dip till 21-EMA at 66.55.