You could easily figure out bearish sentiments in WTI crude prices from the last couple of days, current prices dips are on the verge of 5-weeks lows.

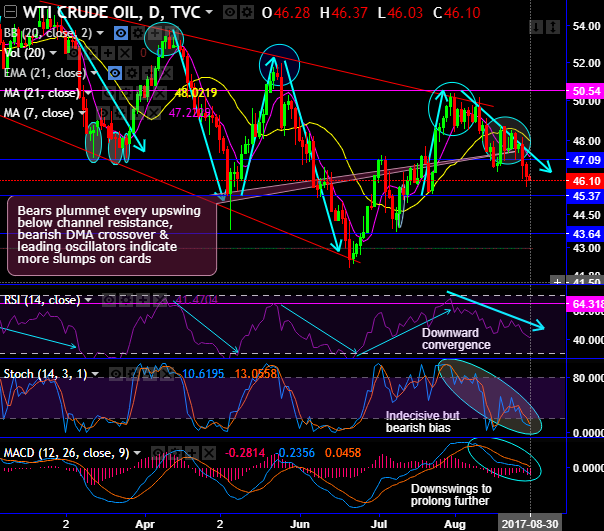

Bears managed to plummet prices on every upswing below channel resistance, while bearish DMA crossover & leading oscillators also indicate more slumps on cards (refer daily chart). Tumbled below DMAs yesterday, prolonging slumps today as well ahead of the lingering speculation on weekly inventory data announcement (by US EIA) which is due later in the US session.

On a broader perspective, the consolidation phase in the major trend drifts in the symmetric triangle pattern, tests resistance at the downward trend line, consequently, the current prices slide below EMAs. For now, the selling sentiments are coupled by both leading oscillators.

The current prices in minor trend slid below DMAs and major trend below EMAs, while bulls check support at ascending triangle baseline but restrained below 21EMAs. Last month also, the crude price upswings have been restrained at the stiff resistance of $50.38 (i.e. 21EMA levels).

RSI signals overbought pressures by evidencing the downward convergence to the price declines on the daily chart. While stochastic curves have also been converging downwards on both time frames.

To substantiate this bearish stance, daily MACD signals downswings may extend further. Our last call is well on the verge of achieving southward targets. Hence, we don’t encourage long-term long build ups, instead, we uphold our previous recommendation of shorts in WTI crude of mid-month tenors as the underlying price of this energy commodity may slide again upto 45.35 levels (next strong support), or even upto 43.64 levels upon breach below 1st target, maintain strict stop at $49 levels.

FxWirePro launches Absolute Return Managed Program. For more details, visit: