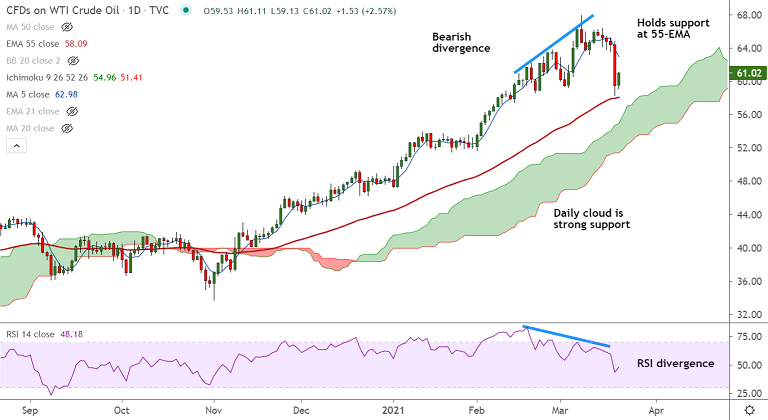

USOIL chart - Trading View

US oil has trimmed some of the previous session's losses and was trading 1.87% higher at 60.56 at around 08:40 GMT.

Oil prices plummeted across the Atlantic overnight amid vaccine concerns and technical selling.

Crude oil prices remain under pressure amid higher oil inventories and unabated pandemic concerns.

Focus now on the driller Baker Hughes' weekly report on US oil rig count on Friday. Analysts suggest further crude oil inventory builds are likely in the coming weeks.

That said, OPEC+ members remain flexible, cooperative and seemingly eager to keep crude oil prices supported.

Long-term bias for crude oil markets remains positive. Pullbacks are likely to be short-lived and shallow.

55-EMA is immediate support at 58.09. Break below will see test of cloud support at 54.96. Breach below cloud could change near-term dynamics.