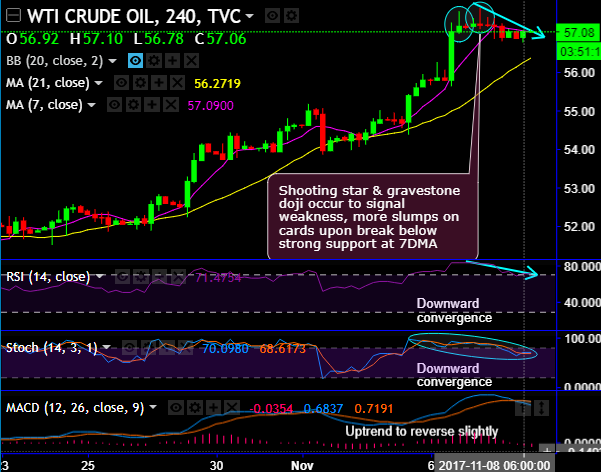

Active bears in WTI crude breach ascending triangle supports, interim price dips backed by both leading and lagging oscillators:

Shooting star and gravestone doji candle patterns have occurred at $57.22 and $57.24 levels respectively.

Subsequently, we reckon that the interim bearish swings in the consolidation phase are coupled by both leading and lagging oscillators on daily terms (refer 4H chart).

The current crude prices have been showing downside momentum after the formation of these bearish pattern candles.

After the stern streaks of bullish rallies, the price behavior now seems to be forming whipsaws pattern (refer rectangular area on 4H chart).

Bears have been plummeting prices below 7DMA ever since the formation of these bearish patterns, more dips likely on the slide below 7DMA.

RSI displays the overbought pressures by showing downward convergence to the mild price declines. While stochastic curves have been indecisive but bearish bias alerting with overbought pressures.

To substantiate the prevailing weakness, MACD signals a potential uptrend reversal briefly.

But on the flip side, it’s been quite puzzling from the broader perspective. The consolidation phase from last more than a year or so, one could very well figure out that every attempt of upswing has shown the failure swings as and when it approaches symmetric triangle resistance. But the bulls have managed to break-out this level.

However, wise to wait for the sustenance above this level for a better clarity on uptrend continuation.

Aggressive bulls can test their luck upto the next stiff resistance upto $60.10 mark as both the leading and lagging oscillators on this timeframe signals uptrend continuation.

We encourage cautious shorts in WTI crude of near-month expiries for targets of $56.37 levels with strict stop loss of $57.67 levels, thereby, the trade carries attractive risk-reward ratio (approx. 1:1).

The prime focus now shifts concerning the official US Govt. crude stockpiles data that’s due later in the day, particularly after yesterday’s bullish API report, that evidenced yet another draw in the US crude inventory for the last.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios