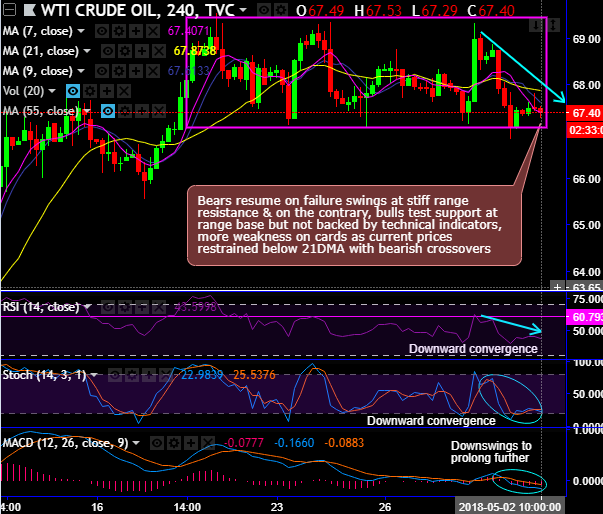

Bears resume at $67.81 levels (near 21DMA) with a sharp shooting star. Consequently, price dips through 7DMAs (on the daily chart).

Prior to which, on the contrary, bulls test support at range base but these bull swings are not backed by both leading and lagging indicators.

In minor trend, more weakness seems to be on cards as the current prices restrained below 21DMA with bearish DMA and MACD crossovers.

On the failure swings at the stiff range resistance of $69.31 levels, consequently, evidence the steep slumps.

Both leading oscillators (RSI & stochastic curves) have been bearish bias by showing downward convergence. While bearish DMA and MACD crossovers indicate downside is likely to prolong further.

On the contrary, ever since the bulls in consolidation phase breaks symmetric triangle resistance, the prices spike well above EMAs but for now, seems slightly edgy at 50% Fibonacci levels, on a broader perspective, more upswings likely on bullish EMA & MACD crossovers (refer monthly plotting).

While both leading, as well as lagging indicators on this timeframe, converge upwards to the price upswings that signal the strength and the intensified buying momentum in the consolidation phase.

Most importantly, the impulsive nature of the rally implies a bullish character shift, especially given the effective test of key support at the March and February lows. With this week’s advance leading to a break of important initial resistance levels, the more immediate focus is on the January highs.

Given the extent of the rally, we sense some near-term pause is likely to develop against these key levels, but eventual new highs appear increasingly likely consistent with our view that the medium-term uptrend is incomplete.

The renewed upside bias is in line with the break of the important 67.50 resistance zone for WTI.

Overall, one can expect more dips in the near-terms, and the extension of consolidation phase in the major terms despite weakness in the short run.

Hence, one can think of writing strangles by shorting 0.5% OTM calls of 1m tenor and short 0.5% OTM put of similar expiries as shown in the diagram.

Alternatively, aggressive bulls can initiate longs in futures contracts of mid-month tenors in order to arrest upside risks. Holders in a futures contract are expected to maintain margins in order to open and maintain a longs futures position.

FxWirePro launches Absolute Return Managed Program. For more details, visit: