The oil section of the midyear Commodities outlook called for an acceleration in global stock draws as we progress through the third quarter. This week’s US EIA data offer some evidence that this is starting to happen.

However, with US crude stocks still c.100 mb above the five-year average (roughly equal to a surplus of 25%), the pace of adjustment needs to accelerate if our price forecasts are for 3Q’17 are to be realized. Pivotal to the current price forecast of $50/bbl for Brent in 3Q’17 is the assumption that OPEC’s production restraint will, in the short term, remove some, but not all of the excess inventories present in the market.

Conversely, oil prices will need to ration US shale growth as the marginal source of non-OPEC production, and despite the recent slowing of US rig count growth.

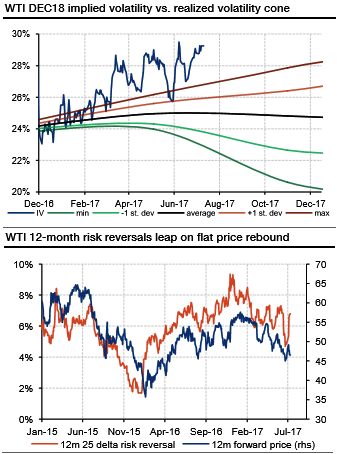

Crude oil implied volatilities moved moderately higher in the recent past, the term structure of implied volatility shifting upwards by approximately 1% for both Brent and WTI options. 12-month at-the-money implied volatility on WTI is now above 30%, the highest level since the December 2016 OPEC meeting.

Meanwhile, ATM IV levels on WTI JUN18 options are currently trending higher above 31%, moderately higher than the levels recorded on the DEC18 contract.

Compared to realized volatilities, long-dated WTI and Brent options seem expensive. The topmost chart plots WTI ATM implied volatilities for options written on the DEC18 contract, alongside with the historically realized volatility cone.

Volatility cones are shown to compare implied volatility levels with realized volatility sampled over time periods corresponding to the remaining time to maturity of the options. At 29.25%, ATM DEC18 implied volatility is currently 5 percentage points above the average 18-month realized volatility (black line). Sources: Soc.Gen.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate