Major downtrend of GBPJPY is still robust, since 10th October we saw whipsaws pattern, the pair hasn’t moved anywhere beyond 128.498 northwards nor even 125.289 on southwards. But for now, the current prices jump above DMAs with bullish crossover after whipsaws to hit fresh 8-weeks highs of 134.324 levels.

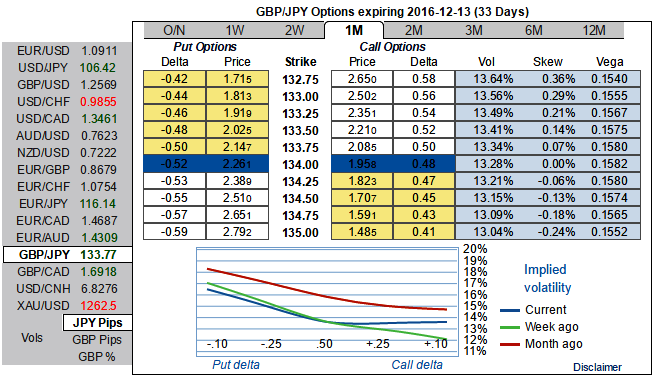

1m IVs clearly signifies that the OTC market participants’ interests still towards bearish effects, as a result, thus, it is needless to say, selling expensive GBP puts should prove profitable amid such a mild updraft in GBPJPY spot.

Contemplating risk reversal adjustments, we foresee the opportunities in writing overpriced ITM puts coupled with adding long positions in ATM delta puts long-term tenors.

As shown in the diagram, one can add 2w (1%) ITM shorts while going long in ATM -0.49 delta puts with preferably longer tenors comparing to the short leg. Please be noted that the tenors chosen in the diagram are just for the demonstration purpose only, use narrow expiries on the short side.

So it is advisable to initiate Diagonal Credit Put Spread (DCPS) in order to tackle both short-term upswings and major downtrend.

For the ease of understanding, we’ve just considered this option strategy with shorts in 1W (1%) ITM put with positive theta or closer to zero while buying 1M (0.5%) OTM put option; the strategy could be executed at net credit.

You could also observe positive cash inflows are certain from the nutshell showing payoff structure as long as the underlying spot remains well below 135.268. But please note that the tenors shown in the diagram are just for demonstration purpose only, use accurate tenors as stated above.

Theta on short side measures time decay in your options premium value per day which means the premiums on short leg today is worth more than over every time break even if the underlying spot doesn’t move anywhere, all else been equal, the option premium should be waning out. This would be the case even when underlying spot never goes up but remains in sideways.

Option sellers can reap the benefits of a high Theta near expiry by selling short-dated ATM options with the expectation of little to almost no market movement.

Thereafter, the major trend prolongs to evidence further slumps, narrowed OTM longs would mitigate downside risks on the other hand as the holder of such option would be having right sell at predetermined strikes.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis