Fundamental driving forces and risk profiling:

1) Diplomatic ties are under increasing strain

2) The real yields have declined

3) The positive effects of credit stimulus programmes from earlier this year may wane

4) The risk of early elections has increased

5) CBRT’s credibility may come under pressure and

6) Turkish residents have resumed accumulating foreign currencies.

USDTRY traded up to 3.85 on the onset of the news and retraced to 3.6377 currently. We do not expect the recent diplomatic spat between Turkey and the US to have any significant macroeconomic consequences, although the headline noise could persist. The direct economic impact will be limited as US visitors account for only 1.2% of annual tourist arrivals in Turkey.

Meanwhile, the sentiment channel is clearly more important given Turkey is reliant on portfolio inflows to finance its current account deficit. However, in absence of escalation and any direct economic damage, we also expect the sentiment impact to gradually wane in coming weeks. In our view, USDTRY overshot due the stretched positioning, but positioning should now become more balanced.

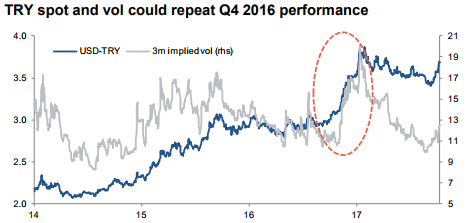

Buy the tail: Relative to recent history, implied vol and risk reversals are not high. Current 3m implied vol (12.5) could spike to the 16-20 area if accelerated depreciation did occur, while risk reversals could easily rise by 1-2 vol points.

Turkish lira implied volatility and risk reversals are among the highest in emerging markets. However, relative to recent history, they are not high in their own right.

Current 3m implied vol (12.5) could spike to the 16-20 area if accelerated depreciation did occur, while risk reversals could easily rise by 1-2 vol points.

This lends itself to owning volatility, and given the difficulty in ascertaining the probabilities of a “spike followed by a recovery” versus a “trend” move higher in USDTRY, we prefer a one-touch structure over a European digital. Hence, buying USDTRY 3m one-touch knock-in 4.35 has been advocated.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One