Euro surged to its sturdiest multi-years high level against sterling, owing to the central banks’ policymaking and to the diverging economic themes for the Eurozone as well as the UK.

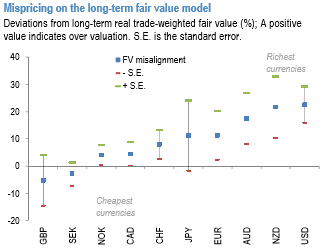

The major G10 driving forces have been NOK and JPY (outperformed) as well as Sterling, Kiwis and Swiss franc (underperformed). Following recent weakening, Sterling is now once again seems the underpriced among the pool (refer above chart).

However, the weakness is not outsized relative to longer-run history and there is scope for GBP to weaken further if political or cyclical risks intensify (refer above chart).

Scandis continue to screen cheap despite recent outperformance, a view consistent with our bullish views on these currencies. On a more granular basis, SEK is modestly cheaper than NOK on this framework.

G10 petro-currencies have outperformed in recent months, yet continue to appear substantially cheaper vs. the Antipodeans. AUD and NZD, alongside, USD remain the richest currencies when ranked on this metrics. The underperformance of AUD and NZD vs. other high beta currencies is a view we have been highlighting in our forecasts for over a year.

Trade tips:

Contemplating above factors, with a view to arresting the underlying spot price fluctuations, we advocate below trades.

Short 2w AUDUSD (1%) OTM put option as the underlying spot likely to go either sideways or spike mildly, simultaneously, go long in 2 lots of Vega long in 2m ATM -0.49 delta put options.

Buy USDNOK vs EURNOK 2M ATM straddle spread, 100:120 vega.

We stay long EUR and SEK, and this week rotate out of our long NOK into CHF, all vs the USD (cash as well as in options).

Buy a 2m 1.1850 EURUSD call financed by shorting a 2m 9.47 EURNOK call.

Courtesy: JP Morgan

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data